Here's what you need to know on Tuesday

Markets:

BTC/USD is currently trading at $8,644 (-0.2% on a day-to-day basis). The coin has been sidelined after volatile weekend. However, the short-term trend is bullish as the recovery may e gaining traction.

The ETH/USD pair is currently trading at $167.0 (+1.2% on a day-to-day basis). The Ethereum retreated from the intraday high of $168.40; however, the short-term rend remains bullish amid expanding volatility.

XRP/USD settled at $0.2364 after a spike above $0.2400 during early Asian hours. The coin has gained 1.77% in recent 24 hours.

Among the 100 most important cryptocurrencies, the best of the day are DigixDAO (DGD) $31.28 (+16.22%), Bitcoin SV (BSV) $300.4 (+11.57%) and MaidSafeCoin (MAID) $0.0846 (+9.16%), The day's losers are, Centrality (CENNZ) $0.0705 (-7.7%), Crypterium (CRPT) $0.4124 (-6.42%) and Bytecoin (BCN) $0.0002 (-5.92%).

Chart of the day:

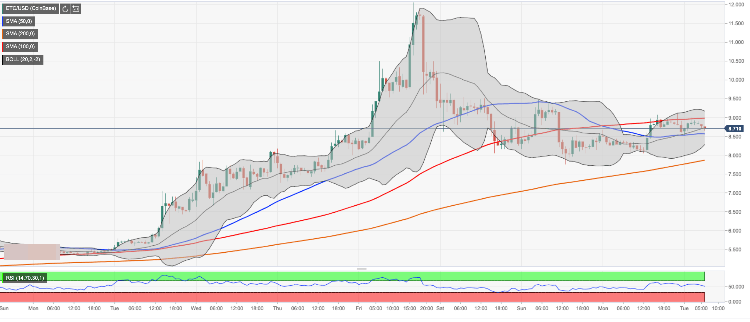

ETC/USD, 1-hour chart

Ethereum Classic jumped by 12% during US hours on Monday as Ethereum creator Vitalic Buterin proposed that ETC may be merged back into the Ethereum network as a shard of the ETH 2.0 network. That would unite the two chains under one roof. However, Buterin emphasized that the technical possibility existed, but the desire of the communities should also be taken into consideration, which is an entirely different story. At the time of writing, ETC/USD is changing hands at $8.87. The coin tested area above $9.00 but failed to hold the ground.

Open interest in bitcoin futures listed on CME (the Chicago Mercantile Exchange) has doubled since the beginning of the year, according to the data, provided by data analytics firm Skew. On January 17 traders opened positions worth $235 million (5,329 contracts), which is twice as much as in early December. Nottably, the open interest grew along with the price and thus confirmed the creation of a bullish trend.

Industry:

The cryptocurrency exchange Bitfinex has lauched sub-accounts features to cater to the growing demand from institutional investors. The new feature will allow users to create up to 100 sub-accounts under one master trading account and employ complex crypto trading strategies. As master account will retain control and full authority for sharing funds between accounts, institutional investors will be able to utilize it to provide different levels of access to employees within the same organization.

Paolo Ardoino, CTO at Bitfinex commented

“There is huge pent up demand among institutional traders for a more sophisticated way of accessing crypto markets. The sub-account feature will facilitate myriad trading strategies across different accounts, and further underlines our capacity to meet the needs of institutional traders pursuing increasingly complex strategies.”

A financial platform 2gether published research on a typical crypto user of 2020. According to the statistical data, compiled from more than 10,000 customers, an everyday crypto user is a male millennial with higher education in finance and law, that spends digital assets mostly in restaurants and grocery stores. Bitcoin and Ethereum are by far the most popular coins for everyday use so far.

Regulation:

HM Revenue and Customs of the United Kingdom is ready to spend $130 million to develop the technologies that would help to identify criminal usage of Bitcoin and other digital currencies, including Bitcoin Cash (BTC), Ethereum (ETH), Ethereum Classic (ETC), XRP, Litecoin (LTC). Notably, the authority is also interested in de-anonomization of so-called privacy coins like Monero (XMR), Zcash (ZEC) и DASH. HMRC invites the applicants to submit their proposals until January 31. Moreover, the tax authority is ready to sign the contract until February 17.

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended Content

Editors’ Picks

Vitalik Buterin slams controversial gambling project ZKasino following scam allegations

Ethereum founder Vitalik Buterin took to Warpcaster, a new type of social network, to condemn ZKasino, a decentralized gambling platform based on Layer 2 Ethereum protocol zkSync.

Starknet jumps 2% after notice inviting specific groups to claim STRK airdrop

Starknet Foundation addressed the groups within the STRK community that were unable to receive the token’s airdrop during the first round. The Layer 2 chain organized an airdrop event in February.

XRP price capped at $0.55 despite retail holdings nearing all-time highs

Ripple price (XRP) failed to break resistance at $0.55 early Wednesday as traders continue to digest Ripple’s recent response to the Securities and Exchange Commission’s (SEC) allegations of illegally selling XRP as a security.

Binance founder Changpeng Zhao could face three-year jail time

US prosecutors are requesting Binance founder and former CEO Changpeng Zhao (CZ) to serve a three-year jail time, according to a Reuters report published Wednesday.

Bitcoin: BTC post-halving rally could be partially priced in Premium

Bitcoin (BTC) price briefly slipped below the $60,000 level for the last three days, attracting buyers in this area as the fourth BTC halving is due in a few hours. Is the halving priced in for Bitcoin? Or will the pioneer crypto note more gains in the coming days?