- BCH is presently sandwiched between the 100-day and 200-day SMAs.

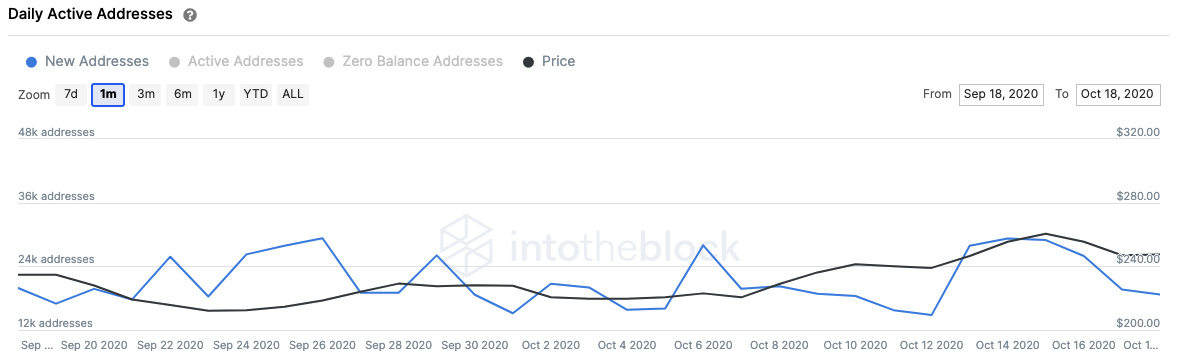

- The number of addresses entering the network has recently dropped.

Bitcoin Cash plummeted from $292.25 to $207.30 between September 2 to September 23. Following that, the price recovered till October 15, hitting the $262.65 resistance line. Since then, the Bitcoin fork has dropped to $249 and is trapped between the 100-day SMA ($253) and 200-day SMA ($246). The MACD also shows decreasing bullish market momentum, which doesn’t bode well for the buyers.

BCH/USD daily chart

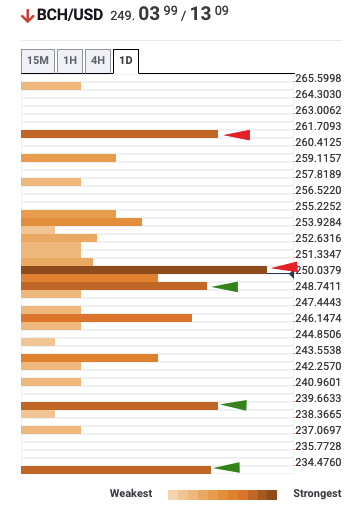

As per the daily confluence detector, there are three healthy support levels at the 200-day SMA ($246), $239 and the 50-day SMA ($232.50). These appear strong enough to absorb an immense amount of selling pressure, capping off the downside at $232.50. A break below these support walls will trigger a fall to $220.

BCH daily confluence detector

To add further credence to our bearish outlook, we can see that the number of addresses entering the network per day. This is a negative sign as declining network growth is usually indicative of a future slumping price. As per the chart, the number of new addresses entering the system reached a high of 29,230 on October 14, over the last month. Since then, the number has dropped to only 18,700, as of writing.

BCH daily active addresses

The Flipside: Can the bulls take back control?

So, while the outlook for now looks pretty gloomy, the buyers can turn this narrative around by conquering two specific levels. Firstly, it needs to cross over the 100-day SMA ($253) and then take over the $262.65 resistance line. By taking control of these resistance walls, Bitcoin Cash should reach $300.

It looks like the whales have been buying the dip. As per Santiment, the number of addresses holding 10,000-100,000 tokens went up from 166 to167 over the last two days. While this may sound negligible, keep in mind that these addresses hold hundreds of thousands of dollars worth of BCH.

BCH holders distribution

Key price levels to watch

The downside is capped by the 200-day SMA ($246), $239 and the 50-day SMA ($232.50) for the BCH bears. These levels are strong enough to absorb immense amounts of sell pressure.

The most urgent task for the bulls is to flip the 100-day SMA ($253) from resistance to support. A break above this resistance barrier should give them enough momentum to aim for the $262.65 resistance.

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended Content

Editors’ Picks

Ripple wipes out weekly gains, experts comment on role of Ripple stablecoin

Ripple declined to $0.52 on Thursday, erasing all gains registered earlier this week. Ripple SVP Eric van Miltenburg’s comments on the firm’s stablecoin, and how it is expected to benefit the XRP Ledger and native token XRP have raised concerns among crypto experts.

Hedera HBAR slips nearly 10% after air is cleared on mistaken link with giant BlackRock

HBAR price is down nearly 10% on Thursday, partly erasing gains inspired by the misinterpreted link with BlackRock. Despite the recent correction, Hedera’s price is up 44% in the past seven days.

The reason behind Bonk’s 105% rise and if you should buy now Premium

Bonk price has shot up 105% in the past five weeks. A retracement into $0.0000216 or the $0.0000152 to $0.0000186 imbalance would be a good buying opportunity. Patient investors can expect double-digit gains from BONK that could extend up to 70%.

Injective price weakness persists despite over 5.9 million INJ tokens burned

Injective price is trading with a bearish bias, stuck in the lower section of the market range. The bearish outlook abounds despite the network's deflationary efforts to pump the price. Coupled with broader market gloom, INJ token’s doomed days may not be over yet.

Bitcoin: BTC post-halving rally could be partially priced in Premium

Bitcoin (BTC) price briefly slipped below the $60,000 level for the last three days, attracting buyers in this area as the fourth BTC halving is due in a few hours. Is the halving priced in for Bitcoin? Or will the pioneer crypto note more gains in the coming days?

[07.57.02, 20 Oct, 2020]-637387617664311545.png)