- USD/JPY's advance has reversed amid trade headlines and mixed US data.

- The last Fed decision of the year and the trade deadline dominate markets.

- Mid-December's daily chart is painting a mixed picture.

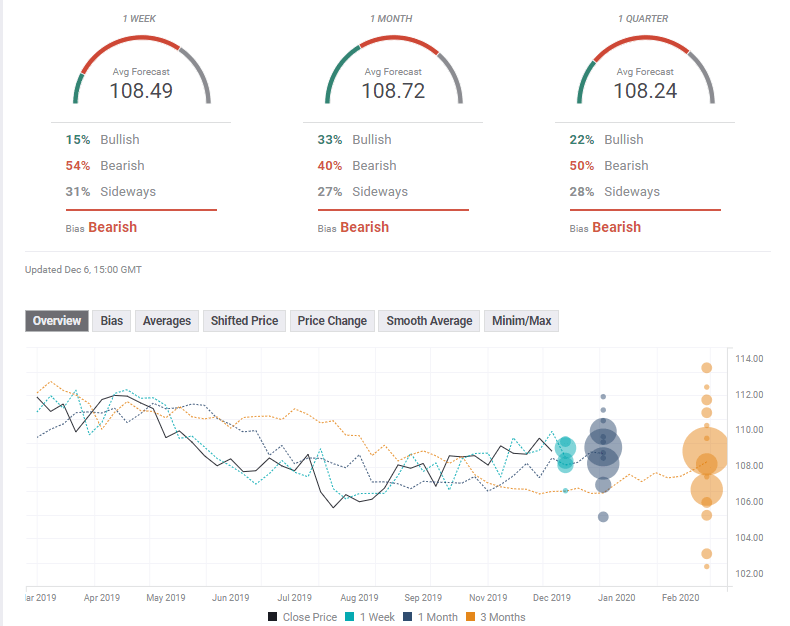

- The FX Poll is showing a bearish bias in all time frames.

Where is the US economy going? And will the US and China sign a deal, avoiding new tariffs? A tumultuous week has seen twists, turns, and high volatility – but no answers to these questions. The upcoming Fed decision and the tariffs deadline may bost action now.

This week in USD/JPY: Trade whipsaw, disappointing data

The world's largest economies remain close to a deal but are not there yet. White House adviser Kellyanne Conway said that the agreement is being written while others suggested that Washington is on course to slap new tariffs on China on December 15.

President Donald Trump said that he may wait until after the November 2020 Presidential elections for signing a deal, but also praised the progress that has been made.

China was angered by another bill in Congress – this time about human rights violations in its western province of Xinjiang. The legislation follows the Hong Kong Act. On the other hand, it offered an olive branch by exempting duties on buying of US agrifoods.

Markets have been reacting to headlines, rising with optimism and carrying USD/JPY with them, while dropping in response to pessimism and sending flows toward the safe-haven yen. However, investors may feel some fatigue amid the incessant headlines and the protracted saga.

The US figures have also failed to draw a clear picture, but trading economic releases were more straightforward. Throughout most of the week, American indicators disappointed. ISM's Manufacturing Purchasing Managers' Index showed a deeper contraction in November, while the services sector is growing at a slower pace according to the forward-looking survey. ADP's private-sector jobs report also fell short of expectations.

The picture changed after the release of the all-important Non-Farm Payrolls – which beat expectations with a leap of 266,000 jobs in November. The gains came on top of upward revisions worth a total of 41,000 additional positions in October and September. However, monthly wage growth fell short of projections with 0.2% and that eroded the dollar's gains.

In Japan, Prime Minister Shinzo Abe introduced a fiscal stimulus package to boost the economy. While unemployment is low, global headwinds may weigh on the world's third-largest economy. The move may ease the pressure from the Bank of Japan to add more stimulus.

US events: Trade, the Fed, and also data

Deal or no deal? If the US and China reach an agreement – at least one providing calm for the near future, markets may cheer and push USD/JPY higher. The minimal accord would include no new tariffs, and China committing to buying more US agrifoods – perhaps a specific amount as Washington wants.

A more ambitious document would include a reduction of previous levies and China pledging to make changes to its intellectual property policies and perhaps other structural issues. In that case, dollar/yen may surge.

However, the probability of a breakup in talks remains elevated. In case the US moves forward with new tariffs, markets may plunge and take USD/JPY with them – even if both sides vow to continue talking. Investors would like to see fewer barriers to global commerce, not new ones.

The Federal Reserve is set to leave interest rates unchanged after three consecutive cuts. Recent economic figures have been satisfactory, especially in the labor market and with a rebound in investment. On the other hand, inflation remains subdued.

Consumer Price Index statistics for November are due out just before the publication and may shape last-minute expectations. Core CPI – the most significant figure – decelerated to 2.3% in October. Any change may move markets.

Traders who will try to gauge what the Fed intends to do in 2020 and the bank's "dot plot" – forecasts for growth, employment, inflation, and interest rates – will provide some clues. Perhaps more importantly, an understanding of the Fed's reaction function – when it may choose to cut or hike rates – is the key.

Jerome Powell, Chairman of the Federal Reserve, has previously set a higher bar for raising rates than for slashing them. He will hold a press conference after the event and confirmation – or dismissal – of the notion may rock the dollar.

See Fed Preview: Is the bar higher for hiking? Powell's may down the dollar, three things to watch

After the dust settles from the Fed, investors are set to focus on the Retail Sales report due out on Friday. The American consumer has been propping up the economy and is set to continue doing so. Headline sales are projected to rise by 0.4% while the all-important Control Group is forecast to advance by 0.4% in November – the month including Black Friday.

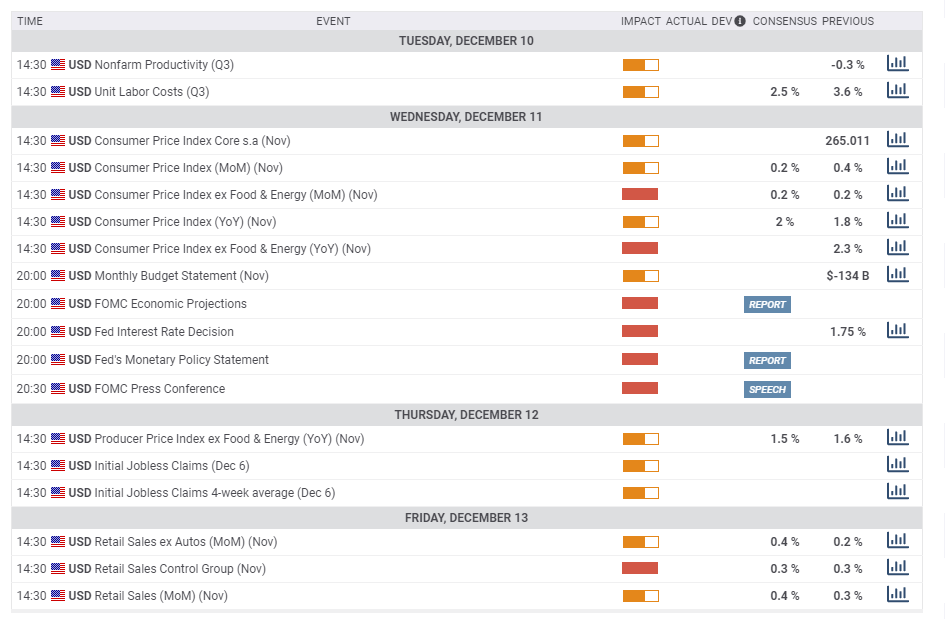

Here are the top US events as they appear on the forex calendar:

Japan: Watch Japanese GDP

The Japanese yen is first and foremost the ultimate safe-haven currency. A breakdown in trade talks may boost the currency. Geopolitical issues may also trigger such flows.

In Japan, the final third-quarter Gross Domestic Product is set to confirm the meager 0.1% growth rate. That may help justify the fiscal stimulus package that Abe is planning.

Later on, the Tankan survey figures for the fourth quarter may move the yen. The figures for the third-quarter pointed to moderate growth, and they may drop in the upcoming publication.

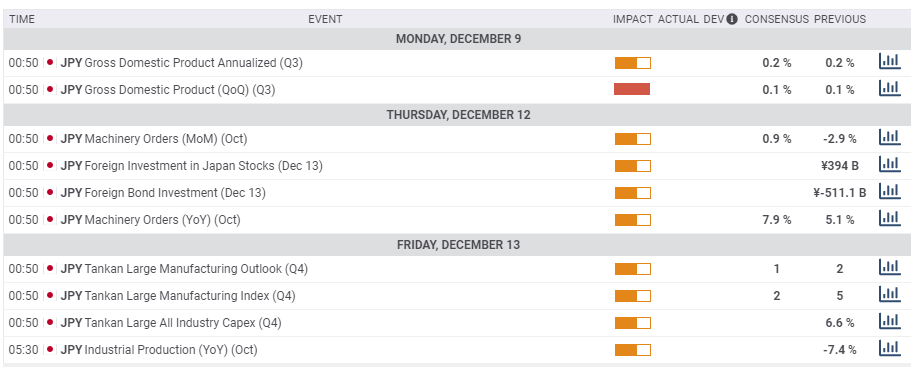

Here are the events lined up in Japan:

USD/JPY Technical Analysis

The clouds are darkening over dollar/yen. It has been unable to conquer the 200-day Simple Moving Average and momentum turned negative. However, it continues clinging onto the 50-day SMA and trade above the 100-day one. The failure to recapture the broken uptrend support line continues weighing on it.

Some support awaits at 108.50, where the 50-day SMA meets the price. Further down, 108.20 provided support in mid-November. It is followed by 107.90, which cushioned earlier last month. The round 107 level worked as support in September and it is followed by 106.55 and 105.75.

Resistance awaits at108.95, which held dollar/yen down in early October. Next, 109.35 was a double-top and remains important. The next level to watch is the December peak of 109.70. Next, 111.65, 111.05, and 111.70, and 112.25 await USD/JPY.

USD/JPY Sentiment

The FX Poll is showing that experts are bearish on all time horizons, albeit with all targets stacking close to each other – at the 108 handle. The short term objective has been pushed lower while the long-term one has been upgraded.

Related Forecasts

- EUR/USD Forecast: Mrs Lagarde’s debut could shake the foundations

- GBP/USD Forecast: Buy the Boris rumor, sell the fact? Jingle polls make or break moment

- AUD/USD Forecast: unsustainable rally to continue only with a trade deal

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

EUR/USD clings to daily gains above 1.0650

EUR/USD gained traction and turned positive on the day above 1.0650. The improvement seen in risk mood following the earlier flight to safety weighs on the US Dollar ahead of the weekend and helps the pair push higher.

GBP/USD recovers toward 1.2450 after UK Retail Sales data

GBP/USD reversed its direction and advanced to the 1.2450 area after touching a fresh multi-month low below 1.2400 in the Asian session. The positive shift seen in risk mood on easing fears over a deepening Iran-Israel conflict supports the pair.

Gold holds steady at around $2,380 following earlier spike

Gold stabilized near $2,380 after spiking above $2,400 with the immediate reaction to reports of Israel striking Iran. Meanwhile, the pullback seen in the US Treasury bond yields helps XAU/USD hold its ground.

Bitcoin Weekly Forecast: BTC post-halving rally could be partially priced in Premium

Bitcoin price shows no signs of directional bias while it holds above $60,000. The fourth BTC halving is partially priced in, according to Deutsche Bank’s research.

Week ahead – US GDP and BoJ decision on top of next week’s agenda

US GDP, core PCE and PMIs the next tests for the Dollar. Investors await BoJ for guidance about next rate hike. EU and UK PMIs, as well as Australian CPIs also on tap.