US Dollar Index

The dollar index turned to red on Monday but remains within a narrow multi-day range, as traders stand aside, awaiting policy decisions from the US Federal Reserve, European Central Bank and the Bank of England.

The US policymakers are widely expected to further slow pace of policy tightening and hike interest rate by 25 basis points at the end of two-day policy meeting on Feb 1, while the other two central banks are likely to opt for 0.5% rate increase each, in the meetings on Thursday.

The dollar remains under strong pressure, holding in a steep fall for four straight months, deflated by dovish turn from Fed, as US inflation decreased in past few months and recent economic data showed that the US economy is performing well so far that boosted risk sentiment.

Analysts support the view of dollar’s further weakening, as the Fed is exiting its cycle of aggressive rate hikes (though the policymakers highlighted the need of further hikes and above initially estimated peak, due to expectations that inflation will remain elevated for some time), while the ECB and BOE are expected to keep hawkish stance, due to more difficult condition of their economies.

Diverging stances and converging interest rate values would add to demand for riskier assets and keep the dollar in defensive.

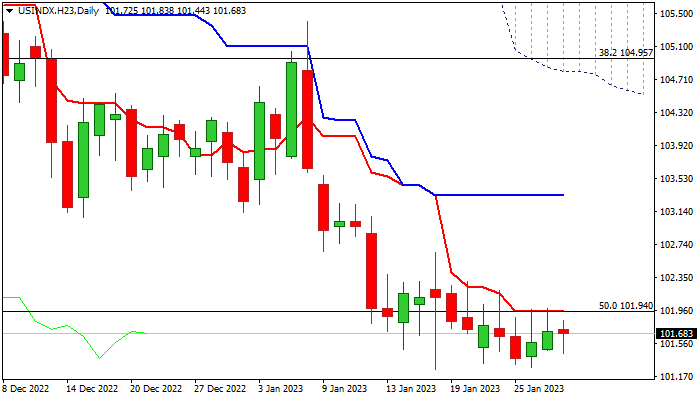

Technical picture remains firmly bearish on daily chart, with initial resistance provided by daily Tenkan-sen (101.94) which recently capped several attacks, followed by daily Kijun-sen (103.32), which should cap extended upticks and keep bears intact.

Res: 101.94; 102.64; 103.32; 104.05.

Sup: 100.52; 100.25; 100.00; 98.92.

The information contained in this document was obtained from sources believed to be reliable, but its accuracy or completeness cannot be guaranteed. Any opinions expressed herein are in good faith, but are subject to change without notice. No liability accepted whatsoever for any direct or consequential loss arising from the use of this document.

Recommended Content

Editors’ Picks

EUR/USD holds gains above 1.0700, as key US data loom

EUR/USD holds gains above 1.0700 in the European session on Thursday. Renewed US Dollar weakness offsets the risk-off market environment, supporting the pair ahead of the key US GDP and PCE inflation data.

GBP/USD extends recovery above 1.2500, awaits US GDP data

GBP/USD is catching a fresh bid wave, rising above 1.2500 in European trading on Thursday. The US Dollar resumes its corrective downside, as traders resort to repositioning ahead of the high-impact US advance GDP data for the first quarter.

Gold price edges higher amid weaker USD and softer risk tone, focus remains on US GDP

Gold price (XAU/USD) attracts some dip-buying in the vicinity of the $2,300 mark on Thursday and for now, seems to have snapped a three-day losing streak, though the upside potential seems limited.

XRP extends its decline, crypto experts comment on Ripple stablecoin and benefits for XRP Ledger

Ripple extends decline to $0.52 on Thursday, wipes out weekly gains. Crypto expert asks Ripple CTO how the stablecoin will benefit the XRP Ledger and native token XRP.

US Q1 GDP Preview: Economic growth set to remain firm in, albeit easing from Q4

The United States Gross Domestic Product (GDP) is seen expanding at an annualized rate of 2.5% in Q1. The current resilience of the US economy bolsters the case for a soft landing.