The dollar index is trading bearish as risk sentiment rises, and investors are looking to invest in safe-haven assets. Trump was due to attend a meeting of NATO in London on Tuesday, where he told the reporters that "I have no deadline, no." He said that he would like the idea of waiting until after the election for a trade deal with China. He also added that China wanted to make a deal now, and he would see if the deal was going to be right because it got to be correct.

These comments from Trump put pressure on stock prices and gave strength to the safe-haven assets like gold. Traders moved towards government bonds and drove the yields on 10-year U.S. Treasury note to a 1-month low of 1.7%. The U.S. Dollar Index also weakened on Tuesday against the basket of six currencies.

XAU/USD - Boosted Safe Haven Appeal Drives Gold Higher

Gold prices closed at $1477.32 after placing a high of $1481.78 and a low of $1459.81. Overall the trend for gold remained strong Bullish that day. On Tuesday, Gold prices reached four weeks high level after Trump pushed the deal with Beijing beyond 2020. U.S. President Donald Trump has said that the trade deal with China might have to wait until after the U.S. presidential election in November 2020. This news damaged the positive hopes of traders that the two largest economies would soon sign the phase-one deal to ease their damaging trade war.

Last week, reports were in favor of phase-one deal completion when both parties commented that they were making progress in negotiating the core issues of the phase-one deal, including the protection of Intellectual property rights. But some issues like the removal of existing U.S. tariffs and Chinese purchases of U.S. agricultural products were still unresolved and under discussion.

On Monday, Trump said that he would impose Brazil & Argentina with trade tariffs for the devaluation of their currencies. He then threatened to put duties of up to 100% on French goods because of digital services tax, which harm the U.S. tech companies.

XAU/USD - Daily Technical Levels

|

Support |

Pivot Point |

Resistance |

|

1464.34 |

1473.12 |

1486.32 |

|

1451.14 |

1495.1 |

|

|

1429.16 |

1517.08 |

Gold - XAU/USD- Daily Trade Sentiment

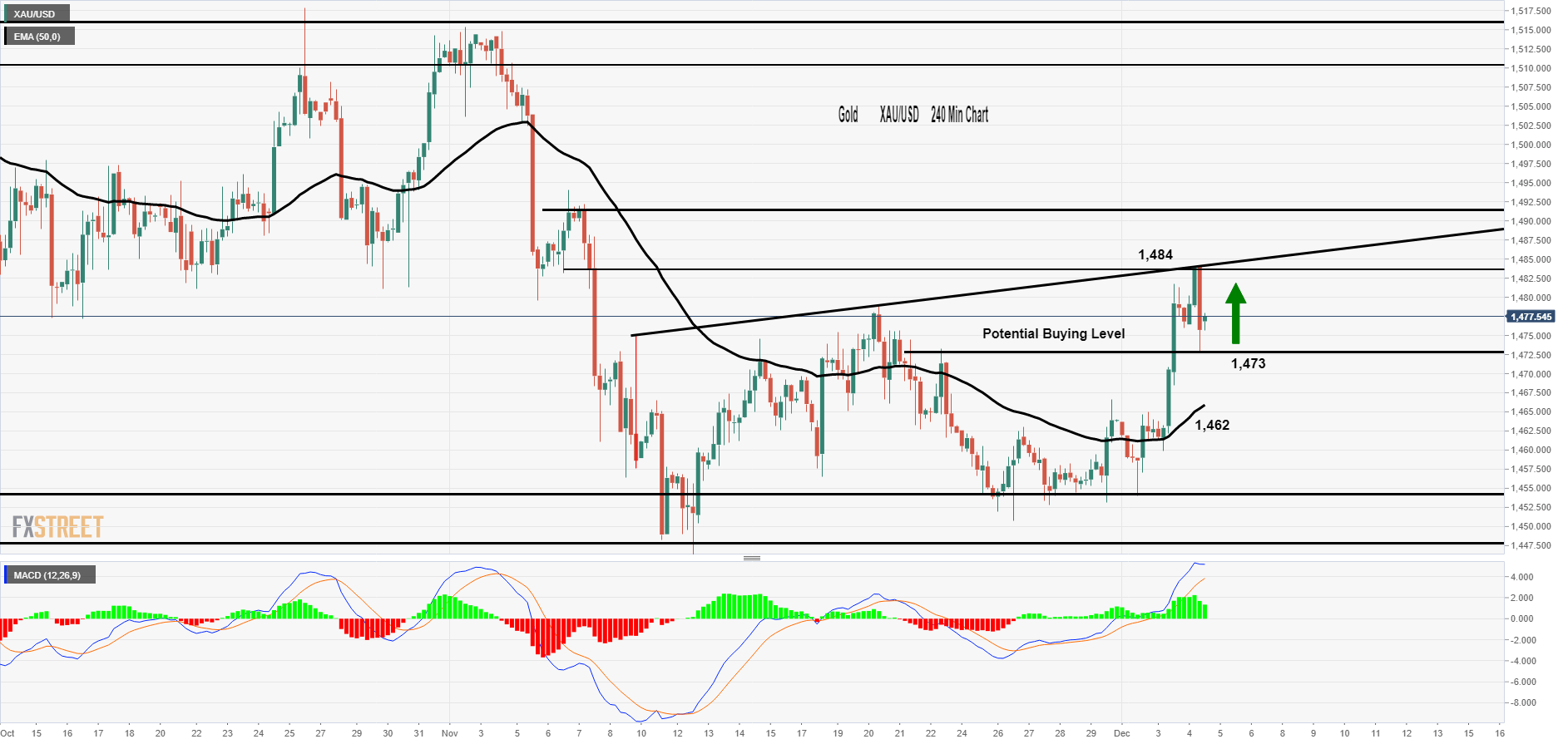

Fellas, gold has traded dramatically bullish during the early European session to place a high around 1,484. On the 4 hour timeframe, the upward trendline is adding pressure on gold technically, while traders await ADP figures during the U.S. session.

Gold has formed three while soldiers above 50 periods EMA which are suggesting chances of a bullish trend. For now, gold may continue to trade above 1,473 and bearish below 1,484 until we see a breakout.

USD/CAD - BOC Rate Decision Ahead

The USD/CAD closed at 1.32943 after placing a high of 1.33208 and a low of 1.32830. Overall the trend for pair USD/CAD remained Bearish that day. The American Petroleum Institute (API) has estimated 3.72M barrels of Crude Oil Inventories against the analyst expectations of 1.798M barrels. The larger than expected crude draw from American Petroleum Institute raised the Crude Oil prices on Tuesday, which supported commodity-linked currency – Loonie to gain traction in the market against U.S. Dollar.

Stronger Canadian Dollar against weaker U.S. Dollar put pressure on USD/CAD prices and moved the pair inn Bearish trend for the day.

U.S. Dollar remained under pressure on Tuesday after the drop of U.S. 10-year Treasury yield to 1.70% and latest comments from Trump to extend the phase-one deal completion after 2020 elections.

Bank of Canada is expected to leave its interest rates at 1.75% this week, but the current global situation with increased trade uncertainties has raised the hopes that BoC would ease this time. Bank of Canada has not acted as of yet against the global economic slowdown, although many peers have eased this year.

The resilient economy of Canada has maintained the Canadian Dollar as the top of the G10 currencies. But with the U.S. economy slowing further in 2020 and the global economy along with it, the chances for the economy of Canada to remain isolated from global slowdown are becoming less day by day.

There were no macroeconomic data releases this day from Canada. Still, later this week, on Friday, many essential data like Employment change & Unemployment rate are due, which would further affect the movement of USD/CAD.

USD/CAD - Daily Technical Levels

|

Support |

Pivot Point |

Resistance |

|

1.3279 |

1.33 |

1.3317 |

|

1.3262 |

1.3338 |

|

|

1.3225 |

1.3375 |

USD/CAD - Daily Trade Sentiment

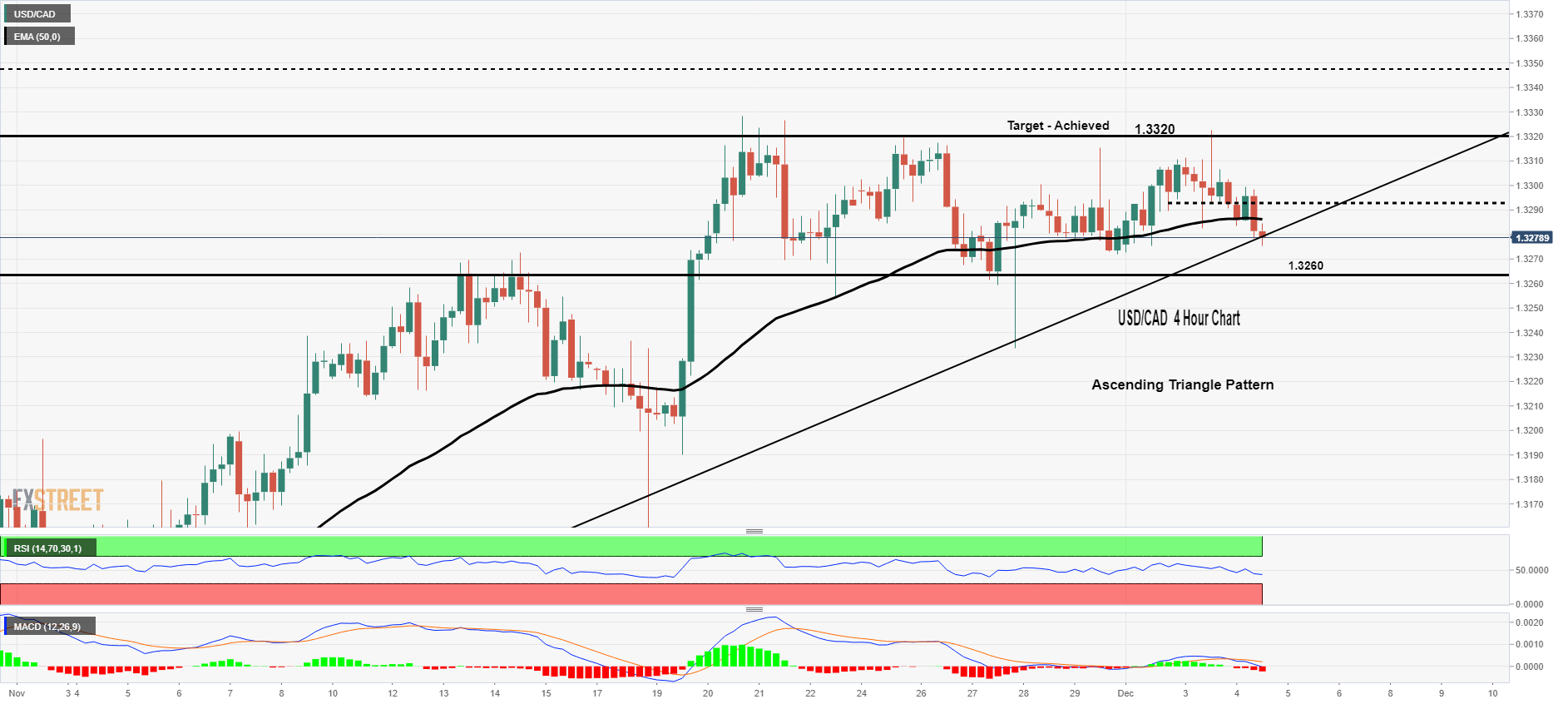

The USD/CAD pair, which was trading bullish recently, has promptly taken a bearish shift to trade at 1.3278. As we know, the bearish move has come in reply to a weaker dollar amid worse than anticipated manufacturing PMI figures.

Furthermore, the safe-haven appeal has triggered sell-off in the Dollar, which is also making the USD/CAD pair weaker. The USD/CAD may find next support around 1.3260, and that's the level where I would like to enter a buy trades.

AUD/USD – Descending Triangle Violates

AUD/USD closed at 0.68460 after placing a high of 0.68620 and a low of 0.68149. Overall the trend for AUD/USD pair remained Bullish that day. At 5:30 GMT, the Australian Bureau of Statistics published the Current Account report, which showed a growth of 7.9B against the expectations of 6.1B and supported Aussie. At 8:30 GMT, the Cash Rate from Reserve Bank of Australia remained flat at 0.75%.

The Australian Central Bank decided to leave the benchmark interest rates on hold at the record low level of 0.75% in its latest policy meeting on Tuesday. The decision to hold its interest rates was according to the market expectations.

RBA released its Monetary Policy Statement, which stated that the outlook for the global economy was reasonable, but the risks tilted to the downside. According to the statement published by RBA, the interest rates would remain low for an extended period of time.

RBA sees its inflation level close to 2% in 2020 and 2021 and is prepared to ease its monetary policy further if needed. According to the statement, the weak household income growth has weighed on spending, and a lower cash rate has put downward pressure on Aussie. It is also expected that unemployment in Australia would fall below 5% in the upcoming years.

The statement released on Tuesday was a little more constructive than in November. RBA repeated in its report that the economy of Australia has reached its turning point, but uncertainty on the outlook for consumption was still there. The lift in wages would help push inflation to the 2-3% range.

Meanwhile, RBA refrained from providing any clear indication of unconventional monetary policy tools. This move by RBA with the increased uncertainties on global trade developments after the tariff hike from Trump caused U.S. Dollar weaker and Aussie stronger against its counterpart. Hence, AUD/USD moved near 3-weeks highest level and remained under Bullish trend on Tuesday.

AUD/USD - Technical Levels

|

Support |

Pivot Point |

Resistance |

|

0.6834 |

0.6848 |

0.6862 |

|

0.682 |

0.6876 |

|

|

0.6792 |

0.6904 |

AUD/USD - Daily Trade Sentiment

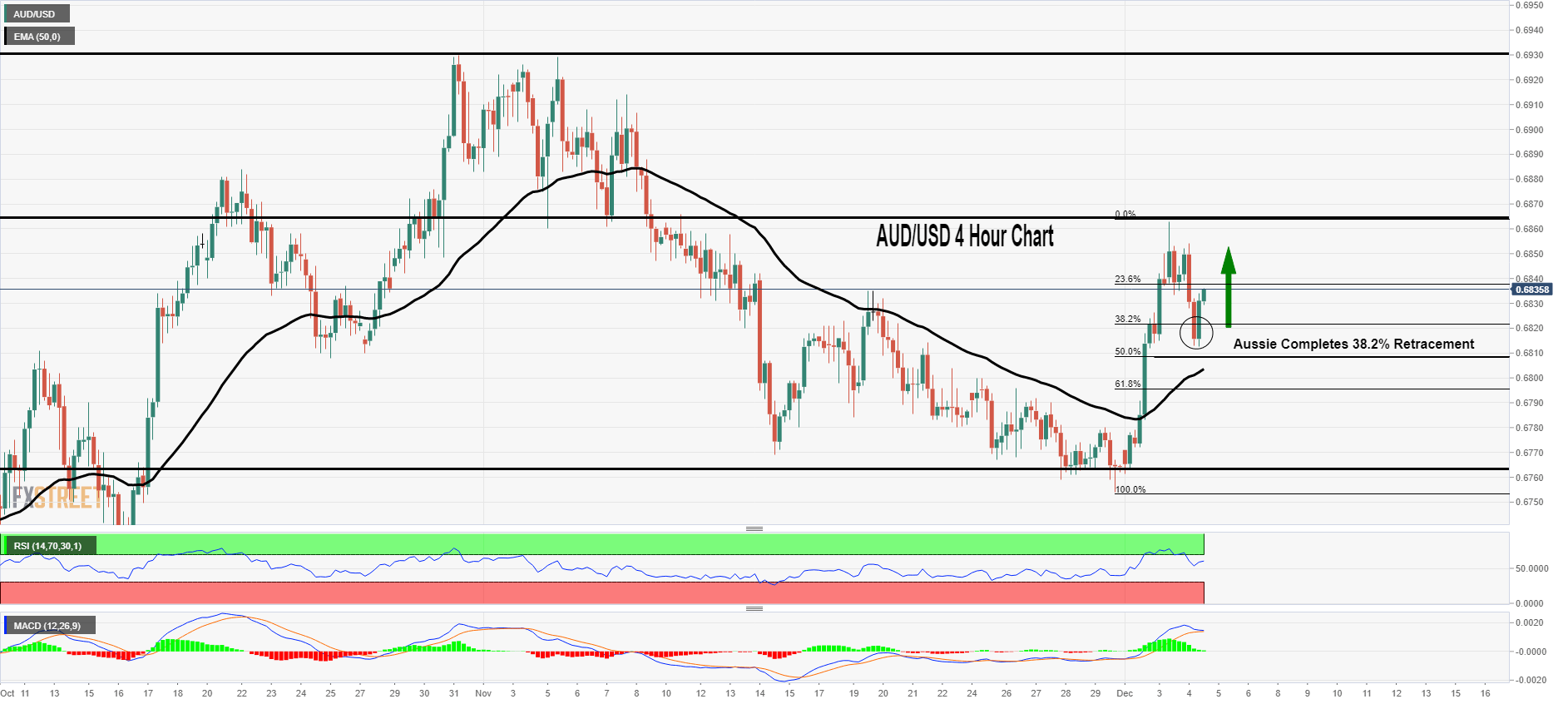

Recalling our previous forecast, the overbought AUD/USD plunged to complete 38.2% Fibonacci retracement at 0.6820. Above this, the Aussie has formed a bullish engulfing pattern, or we can say it's tweezers bottom pattern. Typically such patterns drive the bullish trend in the market.

With that being said, the AUD/USD may trade bullish above 0.6820 to target 0.6850 and 0.6868 while the immediate support stays around 0.6800.

Risk Warning: CFD and Spot Forex trading both come with a high degree of risk. You must be prepared to sustain a total loss of any funds deposited with us, as well as any additional losses, charges, or other costs we incur in recovering any payment from you. Given the possibility of losing more than your entire investment, speculation in certain investments should only be conducted with risk capital funds that if lost will not significantly affect your personal or institution’s financial well-being. Before deciding to trade the products offered by us, you should carefully consider your objectives, financial situation, needs and level of experience. You should also be aware of all the risks associated with trading on margin.

Recommended Content

Editors’ Picks

EUR/USD retreats below 1.0700 after US GDP data

EUR/USD came under modest bearish pressure and retreated below 1.0700. Although the US data showed that the economy grew at a softer pace than expected in Q1, strong inflation-related details provided a boost to the USD.

GBP/USD declines below 1.2500 as USD rebounds

GBP/USD declined below 1.2500 and erased the majority of its daily gains with the immediate reaction to the US GDP report. The US economy expanded at a softer pace than expected in Q1 but the price deflator jumped to 3.4% from 1.8%.

Gold drops below $2,320 as US yields shoot higher

Gold lost its traction and turned negative on the day below $2,320 in the American session on Thursday. The benchmark 10-year US Treasury bond yield is up more than 1% on the day above 4.7% after US GDP report, weighing on XAU/USD.

XRP extends its decline, crypto experts comment on Ripple stablecoin and benefits for XRP Ledger

Ripple extends decline to $0.52 on Thursday, wipes out weekly gains. Crypto expert asks Ripple CTO how the stablecoin will benefit the XRP Ledger and native token XRP.

After the US close, it’s the Tokyo CPI

After the US close, it’s the Tokyo CPI, a reliable indicator of the national number and then the BoJ policy announcement. Tokyo CPI ex food and energy in Japan was a rise to 2.90% in March from 2.50%.