The U.S. stocks advanced, buoyed by China's stance in supporting local businesses amid the impact of the coronavirus outbreak. At the same time, minutes of the Federal Reserve's last monetary policy meeting showed that officials were optimistic about the U.S. economy.

Both the S&P 500 (+15 points or 0.5% to 3386) and the Nasdaq 100 (+88 points or 0.9% to 9718) made record-high closes, and the Dow Jones Industrial Average was up 115 points (+0.4%) to 29348. The U.S. government bond prices eased, as the benchmark 10-year Treasury yield edged up to 1.569% from 1.555%. Right now, the traders will keep an eye on the Philly Fed Manufacturing Index.

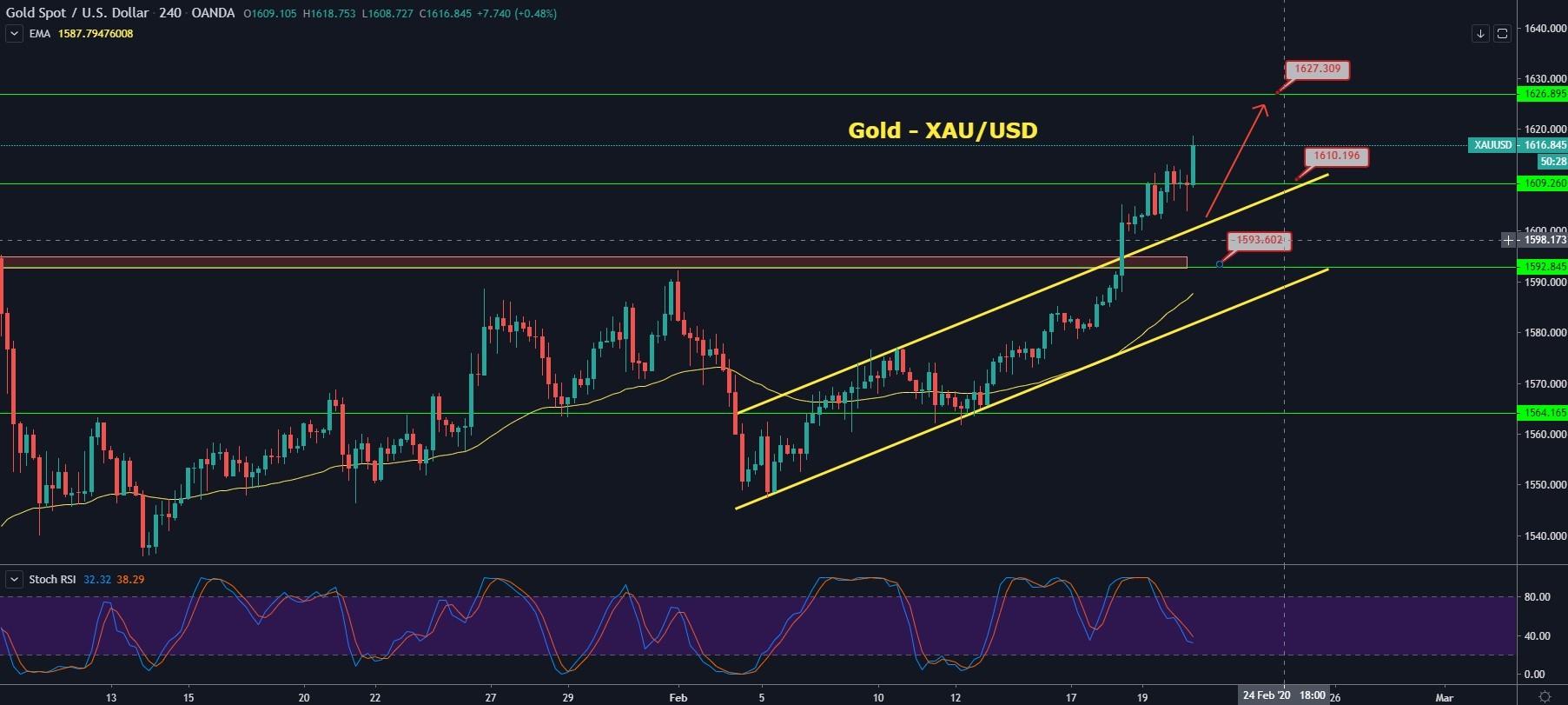

XAU/USD - Risk-off Drive Dramatic Surge

The yellow-metal prices are looking flat because China announced the rate cut to support the economy. The gold is changing sharply, bullish at $1,616.15. The People's Bank of China (PBOC) declared a 0.10% cut to its benchmark interest rates. Details imply a 1-year mortgage prime rate is at 4.05% compared with the 4.15% a month earlier, while a 5-year loan prime rate at 4.75% versus 4.80% a month earlier.

The reason behind this decision is the new coronavirus outbreak, which has caused over 2,000 deaths in the country and almost 75,000 infections, caused widespread disruption to businesses and factory activity in China.

Gold has increased more than 6% so far this year due to concerns about the economic impact, which is caused by the virus. After this week's gains, the yellow metal is now near its high level since February 2013. It is worth to mention that the minutes from the latest U.S. Federal Reserve meeting indicated that they could leave rates unchanged for many months ahead. The U.S. dollar index that follows the greenback against a basket of other currencies was little changed at 99.642.

XAU/USD - Daily Technical Levels

|

Support |

Pivot Point |

Resistance |

|

1604.59 |

1608.81

|

1615.98 |

|

1597.42 |

1620.2 |

|

|

1586.03 |

1631.59 |

XAU/USD - Daily Trade Sentiment

The precious metal gold is trading sharply bullish since it has violated the upward channel at the 1,600 level. So far, it's been trading in line with our previous forecast to hit the target level of 1,611. As of now, it's been trading at 1,616, and the odds of bullish breakout remain pretty solid, which may lead the gold prices towards 1,622 and 1,627.

The RSI and Stochastic values are still holding below 50, which may add bearish pressure on the precious metal. Consider taking buy trades over 1,608 to target 1,622 and 1,628 today.

USD/CAD - CPI Supports Lonnie

The USD/CAD lost 0.3% to 1.3220. Government data showed that Canada's CPI grew 2.4% on year in January (+2.3% expected, +2.2% in December). Other commodity-linked currencies remained subdued against the greenback. AUD/USD slipped 0.1% to 0.6682 while NZD/USD was flat at 0.6388.

Despite rising anxieties about the economic impact of the coronavirus outbreak in China, a slowdown in the number of new cases infected by the deadly virus started to a recovery in the market risk-sentiment, and this was shown after a positive mood around equity markets, which eventually weakened the Japanese yen's safe-haven demand.

At the USD front, the already stronger tone surrounding the greenback got a fresh boost on Wednesday after the release of better-than-expected US economic releases, Producer Price Index (PPI), and housing market data. The Managing Director Kristalina Georgieva gave warning that the on-going spread of the coronavirus outbreak to other countries could derail a highly fragile projected recovery in the global economy in 2020.

Looking forward, the market traders keep their eyes on the US economic docket, highlighting the release of the usual weekly unemployment claims and the Philly Fed Manufacturing Index. The data will likely affect the USD price dynamics.

USD/CAD- Daily Technical Levels

|

Support |

Pivot Point |

Resistance |

|

1.3206 |

1.323

|

1.3245 |

|

1.3192 |

1.3268 |

|

|

1.3153 |

1.3307 |

USD/CAD- Daily Trade Sentiment

On the 4 hour timeframe, the USD/CAD pair is edging higher with a bullish bias around 1.32600, testing the downward channel's trendline, which is extending resistance around 1.3260. Most of the bullish trend has been driven due to increased uncertainty in China regarding Caronovirus, which is driving the bearish trend in the Canadian dollar.

A bullish breakout of the 1.3260 resistance area is likely to lead the USD/CAD prices towards 1.3275 initially and then 1.3330 later on. Conversely, the pair can trade bearish below 1.3260 area until the next support level of 1.3215. Let's see if the pair manages to break the above downward channel or not. Let's take a sell trade below 1.3276 today with a stop somewhere around 1.3300.

AUD/USD – Descending Triangle Pattern

The AUD/USD currency pair went in the red and dropped to 0.6649; the air hit the fresh ow sine February 2009, mainly due to the People's Bank of China (PBOC) announced rate cut during early Thursday. The AUD/USD currently is trading at 0.6643 and consolidates in the range between the 0.6630 - 0.6696.

The People's Bank of China (PBOC) announced a 0.10% easing to its benchmark interest rates. The press release indicates the 1-year loan prime rate went to 4.05% versus 4.15% a month earlier. Also, a 5-year loan prime rate moved to 4.75% against 4.80% a month earlier. It is worth to mention that the central bank announced a reduction in its medium-term lending facility (MLF) earlier this week and had already indicated that the rate cut is coming.

On the other hand, the Aussie unemployment rate disappointed earlier, risk-tone remains moderately positive considering Chinese diplomats' efforts. Before that, Australia's 4th-quarter (Q4) Wage Price Index remained unchanged, around 0.5% QoQ the previous day.

China's coronavirus news pieces continue to present mixed signals with the latest figures from Hubei after a re-revised pattern and mark a sharp decline in the infected counts. However, the market's approve the Chinese policymakers' efforts to appease traders with all the efforts they can. The World Health Organization (WHO) also supports the dragon nation and helps the risk-tone.

AUD/USD - Technical Levels

|

Support |

Pivot Point |

Resistance |

|

0.6674 |

0.6687

|

0.6699 |

|

0.6661 |

0.6712 |

|

|

0.6636 |

0.6737 |

AUD/USD - Daily Trade Sentiment

The AUD/USD fell dramatically after disrupting the descending triangle pattern, which supported the pair around 0.6665. As we can see on the 4-hour timeframe, the AUD/USD has formed three black crows pattern, which is suggesting odds of more selling in the AUD/USD pair.

Since the pair has already met our initial target level of 0.6620, the next target is likely to be 0.6585. Above this level, we can expect a bullish reversal in the AUD/USD pair. The RSI and Stochastics are holding below 20, suggesting odds of bullish correction before we see more selling in the AUD/USD pair. Let's stay bearish below 0.6645 and bullish above 0.6585 today. All the best for the New York session!

Risk Warning: CFD and Spot Forex trading both come with a high degree of risk. You must be prepared to sustain a total loss of any funds deposited with us, as well as any additional losses, charges, or other costs we incur in recovering any payment from you. Given the possibility of losing more than your entire investment, speculation in certain investments should only be conducted with risk capital funds that if lost will not significantly affect your personal or institution’s financial well-being. Before deciding to trade the products offered by us, you should carefully consider your objectives, financial situation, needs and level of experience. You should also be aware of all the risks associated with trading on margin.

Recommended Content

Editors’ Picks

EUR/USD stays below 1.0700 ahead of US data

EUR/USD stays in a consolidation phase slightly below 1.0700 in the European session on Wednesday. Upbeat IFO sentiment data from Germany helps the Euro hold its ground as market focus shifts to US Durable Goods Orders data.

USD/JPY refreshes 34-year high, attacks 155.00 as intervention risks loom

USD/JPY is renewing a multi-decade high, closing in on 155.00. Traders turn cautious on heightened risks of Japan's FX intervention. Broad US Dollar rebound aids the upside in the major. US Durable Goods data are next on tap.

Gold price trades with mild negative bias, manages to hold above $2,300 ahead of US data

Gold price (XAU/USD) edges lower during the early European session on Wednesday, albeit manages to hold its neck above the $2,300 mark and over a two-week low touched the previous day.

Worldcoin looks set for comeback despite Nvidia’s 22% crash Premium

Worldcoin price is in a better position than last week's and shows signs of a potential comeback. This development occurs amid the sharp decline in the valuation of the popular GPU manufacturer Nvidia.

Three fundamentals for the week: US GDP, BoJ and the Fed's favorite inflation gauge stand out Premium

While it is hard to predict when geopolitical news erupts, the level of tension is lower – allowing for key data to have its say. This week's US figures are set to shape the Federal Reserve's decision next week – and the Bank of Japan may struggle to halt the Yen's deterioration.