Have you seen the price of oil recently? I mean come on that is really going down a slippery slope.

Alright, I get it, with all the coronavirus situation getting worse by the day, hundreds of millions of peoples under lockdown, all over the world, with the economy coming to a never ever seen before complete standstill, and stocks getting crushed and hammered down at record speed in the process faster than anything we have seen even than in 1929 and then even putting in the strongest recovery since the 1930ies as well, which pretty much looks like it could well be the first strong but still bear market rally, you may have lost track of what the oil price has been doing meanwhile on top.

And I can tell you by no means is there any less crazy stuff going on there with oil.But let me start at the beginning first.

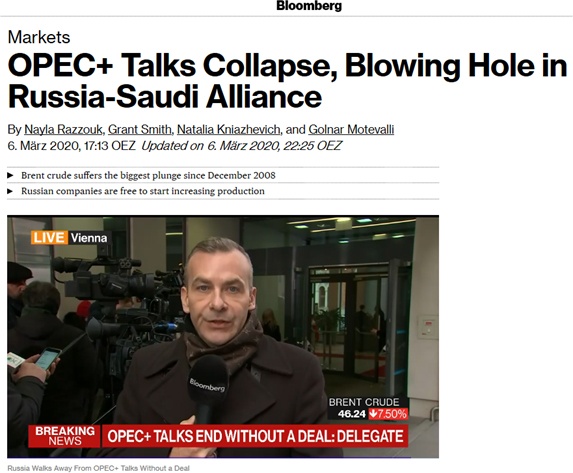

On March 6th the OPEC+ talks collapsed when Russia surprised by not agreeing to further oil production cuts. This was huge news.

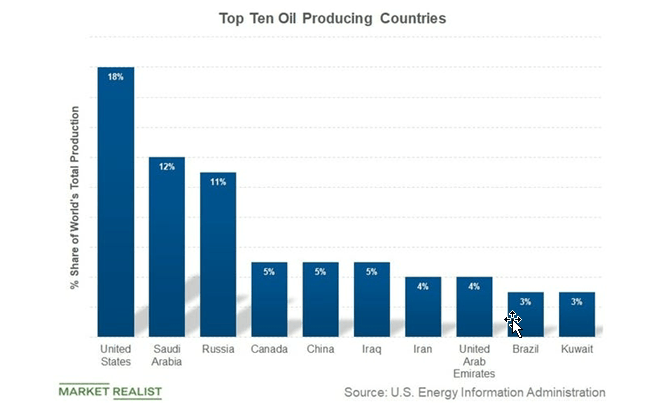

So you have to understand the oil price is actually controlled by a cartel, no it’s not Pablo, but the OPEC, and in fact the OPEC members are 14 of the world’s biggest oil producing countries controlling about 35% of the world’s oil supplies and 82% of proven reserves more or less lead by the Saudi’s.

I guess you could say MbS is their BaBa (the Arabic word for father). You know he’s the kind of leader you don’t want to mess with, in 2017 he rounded up hundreds of the richest and most influential people of his own country, his own people, including close relatives in an attempt to combat corruption of course.

So, all these 14 countries who are members of the OPEC align their oil production output to keep supply and demand balanced in order to keep oil prices at certain levels.

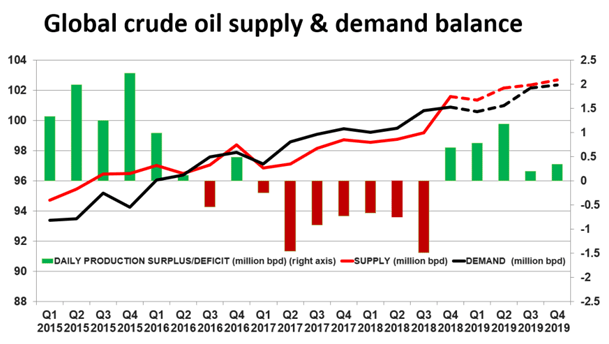

Because like any market if you have too much oil being produced the price is going to go down on over-supply and the other way around a shortage of oil increases the price due to the demand meeting limited supply.

And that is what the OPEC has been doing for several years now, they restricted the amount of oil any OPEC country is allowed to produce to prevent the price from dropping lower.

But then there is also the dark side of the oil producing countries, which are countries that have not been in the OPEC, and in fact it was only in 2016 when the OPEC countries joined forces with other oil producing countries including Russia effectively now controlling 55% of the global oil supply and 90% of the of the proven reserves.

They called this larger group then the Vienna group or simply the OPEC plus super cartel which now included 24 of the world's largest oil producing countries. and they made history in 2016.

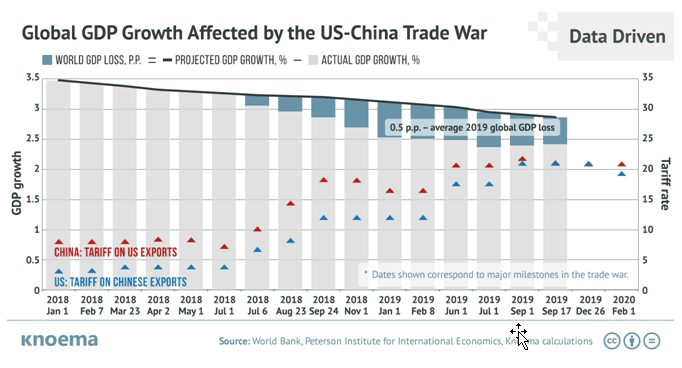

This coordinated effort of the super cartel members in fact helped to keep oil prices high even in the eye of declining oil demand globally in the last year 2019 which we will get to in a little bit.

This price level allowed for the US shale oil production to flourish and rise significantly. Without going into too much details here shale oil production is a lot more expensive than regular drilling, and that is why it requires a minimum oil price for it to be profitable at all which was secured by the effort of the OPEC plus production cuts and ultimately led to a colossal rise US shale oil production.

By now, the US became the biggest oil producer in the world and in fact has been that for a while already now, bigger than Russia and also bigger than Saudi Arabia, did you know that?

When the OPEC plus came together the last time in the face of this corona crisis, Russia was pissed that while they have been curbing their own oil production output for years, and given Russia’s oil companies are mostly state owned, means they make up a sizeable portion of the state’s income, Putin was no longer willing to accept this.

So, Russia decided to no longer agree to further oil production cuts that were essentially only helping the US American shale oil producers to reach world dominance.

Saudi Arabia then was even more pissed by Putin being pissed with the Americans so that the Saudis launched an aggressive oil price war themselves, and dropped the oil bomb.

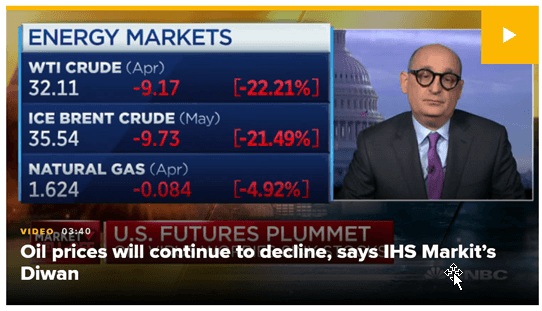

On that weekend the price of oil gapped to the downside by about 30%.

What had happened was, that the Saudis increased their daily crude output by as many as 2 million barrels per day and did so into an already oversupplied global market which ultimately pushed the price of WTI down to the $20 level and at times even a bit below that to an 18-year low!

And this is where it starts hurting everybody. The global economy had already been weakened due to the effects the trade war between the US and China with all the different tariffs that took their toll on the global economy.

Obviously, the Corona crisis which now appears to have been gravely underestimated by just about everyone (but China) first led to a supply shock due to the shutdowns all over China and now to a demand shock due to the shutdowns all over Europe, the US and more or less the whole world now.

In other words, the demand for oil is dead at the moment and we have these two ex-buddies Russia and Saudi-Arabia producing oil like there is no tomorrow hurting themselves and everyone else in the process to punch American oil producers in the face and kick the Americans out of the game.

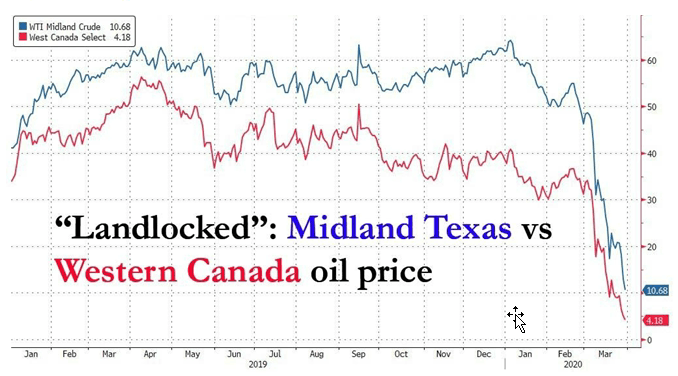

And you know what, its working! so called “landlocked” oil has been dropping rapidly and may even see prices turn negative.

What it means is that storing the oil is more expensive than giving it away for free or even paying for someone to come take it.

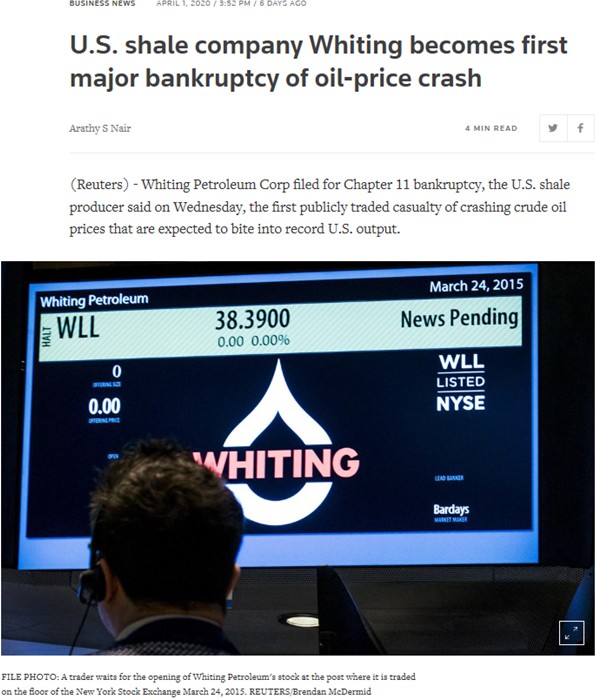

American shale oil producers need an oil price of at least $50-$60 to not lose money every day. Plus they are so heavily in debt, that if they go bust, and first producers have started to go down already, this could turn into a widespread credit crisis and even bring down banks with it as many oil companies in the US are likely to default on their loans with oil prices at these low levels.

And it has already begun:

And in times where the central banks have gone all in with monetary policy and the governments have followed with unprecedented fiscal measures on top, a credit crisis in the US is the last thing that can be allowed to happen. much less something the financial system could possibly survive even.

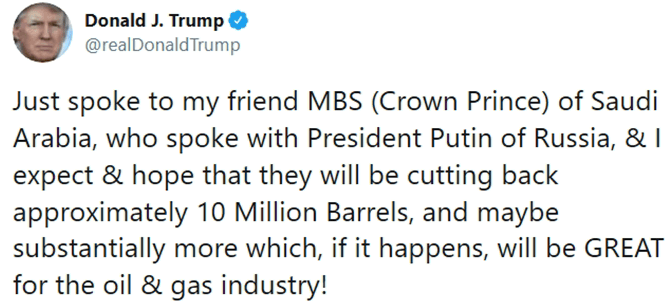

But Mr. President Donald Trump has to come to the rescue, with his feared superpower, the almighty Trump Tweet which he used yesterday and he tweeted that he had spoken to his buddy Mbs, to miraculously cut back the oil production by 10 million barrels daily.

Actually, maybe even by 15 million barrels per day:

And sure enough, Crude prices posted their biggest-one day gains on record. Oil soared as much as 35% after the presidential tweet, and it had never gone that high so fast ever before in its entire history. Now that’s just batshit crazy all by itself but it gets even worse, how?

Because Saudi Arabia and Russia didn’t confirm they had agreed to any cuts. And now the Saudis even called for an urgent meeting of the OPEC+ alliance as they call it now -- which includes Russia -- to reach a “fair deal” that would restore balance in the markets

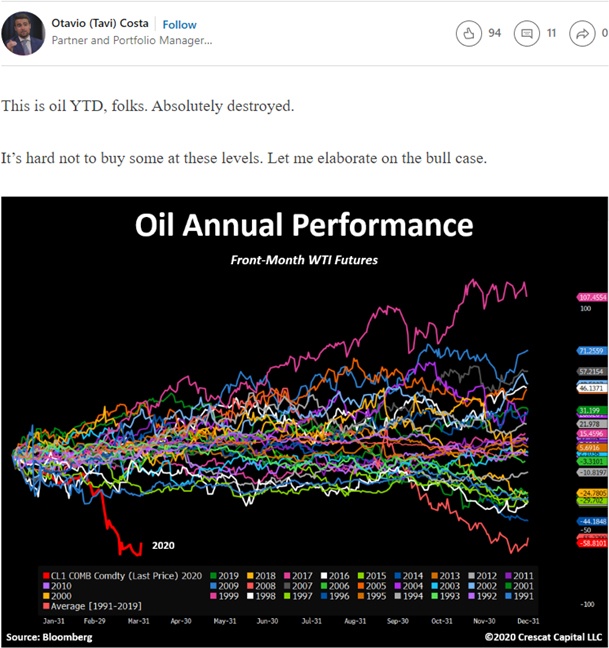

Now on a macro level there are strong reasons to assume that oil prices can and will recover as we see here beautifully put by Tavi Costa from Crescat Capital.Oil on an annual basis is historically low and as he says really “it’s hard not to buy some at these levels”

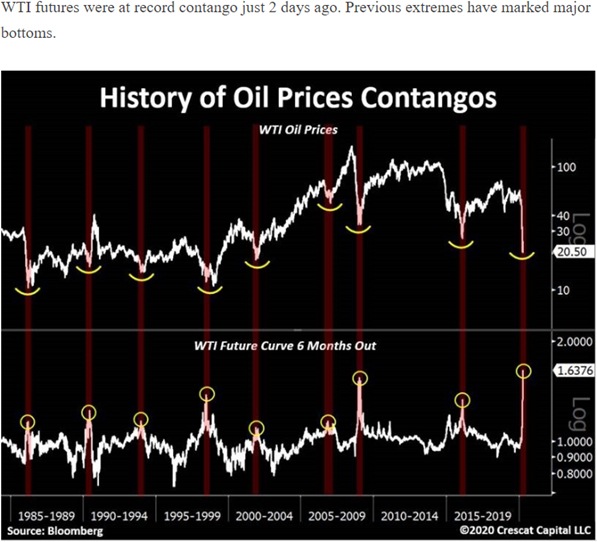

We have a record level of Contango, which basically means the future prices for oil are all higher than the current spot price. This is a special situation in the market that happens when it is heavily expect to see a rise in the price over time.

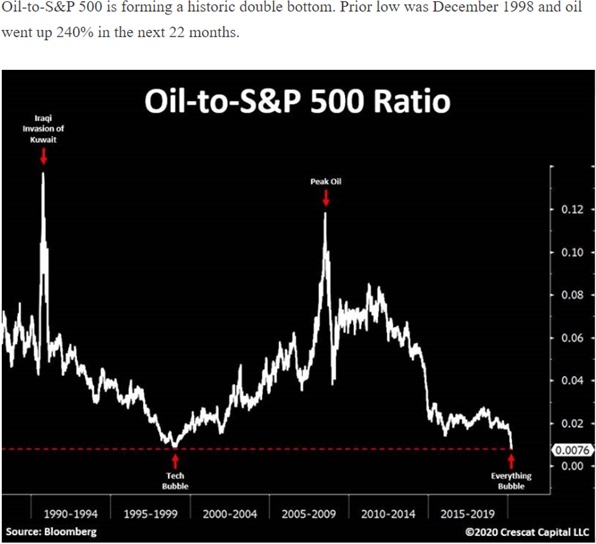

The Oil-to-S&P500 ratio is at its lowest since the tech bubble and the current price of oil is as far away from its 200-day moving average as it hasn’t been before since the bottom of oil prices in the great financial crisis.

And there are several other reasons that he goes on to elaborate here in his analysis of why the energy sector and with-it oil prices may be around a bottom and potentially interesting to buy. The volatility we have seen here recently is incredibly off the charts, historic proportions and better be very careful should you decide to trade anything oil and energy related.

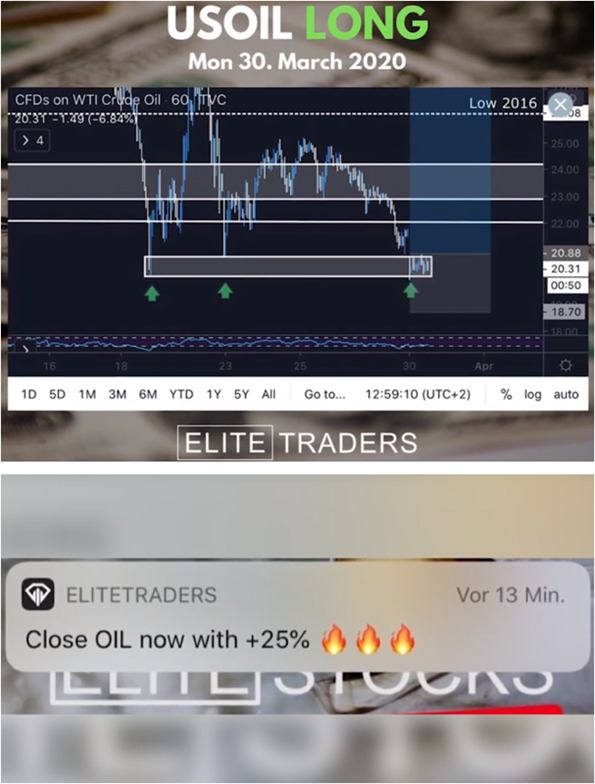

So, as you can see it has been one hell of a slippery slope here with the black gold and it will most likely bring a lot of further trading opportunities with it, if you can identify them correctly and act upon that. Just as we did with here at Elite Traders with our last trade on oil that closed with +300 pips just yesterday.

Recommended Content

Editors’ Picks

EUR/USD clings to daily gains above 1.0650

EUR/USD gained traction and turned positive on the day above 1.0650. The improvement seen in risk mood following the earlier flight to safety weighs on the US Dollar ahead of the weekend and helps the pair push higher.

GBP/USD recovers toward 1.2450 after UK Retail Sales data

GBP/USD reversed its direction and advanced to the 1.2450 area after touching a fresh multi-month low below 1.2400 in the Asian session. The positive shift seen in risk mood on easing fears over a deepening Iran-Israel conflict supports the pair.

Gold holds steady at around $2,380 following earlier spike

Gold stabilized near $2,380 after spiking above $2,400 with the immediate reaction to reports of Israel striking Iran. Meanwhile, the pullback seen in the US Treasury bond yields helps XAU/USD hold its ground.

Bitcoin Weekly Forecast: BTC post-halving rally could be partially priced in Premium

Bitcoin price shows no signs of directional bias while it holds above $60,000. The fourth BTC halving is partially priced in, according to Deutsche Bank’s research.

Week ahead – US GDP and BoJ decision on top of next week’s agenda

US GDP, core PCE and PMIs the next tests for the Dollar. Investors await BoJ for guidance about next rate hike. EU and UK PMIs, as well as Australian CPIs also on tap.