Outlook:

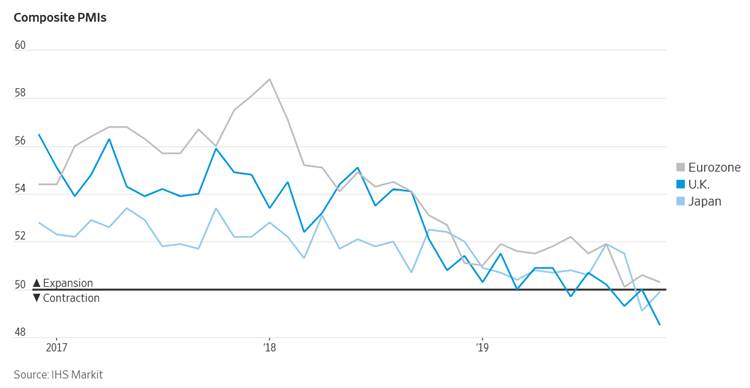

Today we get the flash Markit PMI, following lousy results from the UK, Australia, Japan and the eurozone (see above). We also get the University of Michigan final Nov consumer confidence and the Kansas City Fed.

The global slowdown is starting to give folks the shivers. In her first ECB statement, chief Lagarde said "Ongoing trade tensions and geopolitical uncertainties are contributing to a slowdown in world trade growth, which has more than halved since last year. This has in turn depressed global growth to its lowest level since the great financial crisis." Yesterday the OECD forecasts eurozone growth at 1.2% this year, with Japan getting 1% and the US, 2.3% (but remember the US started the year at 3.3% in Q1 and will likely end it at less than 0.5% in Q4). The OECD said low growth will become standard unless the world takes steps to remove obstacles (aka US tariffs) and raise capital spending. As the PMIs today show, contraction is widespread.

For some reason, Kissinger's visit to China and talk with Pres Xi is not getting any attention in the context of the trade war or FX. But a 96-year old guy doesn't get on a plane to China—which he famously "opened" in 1971—without a darn good reason. To be sure, Bloomberg was holding a "New Economy Forum" in Beijing and Kissinger was a speaker, along with Ray Dalio and other big shots. But as far as we can tell, Kissinger was the only one to get an audience with Pres Xi. Bloomberg reports Kissinger said the world is now in the "foothills" of a new Cold War.

It's possible Kissinger attended the conference because it's important and at the invitation of Bloomberg. It's also possible Kissinger was sent as some kind of envoy by the Trump White House. It's not exactly hard news on the trade war story, but it's something. We just don't know what.

The PMIs will be the main story until we get the US version, then the markets can go back to feeling uncertain about the trigger, the China trade war. A number of standard phrases can be used—treading water among them. Treading water tends to deliver a sawtooth pattern, a little up and a little down, over and over. And next week will be worse, with most of the US taking most of the week off. We say everyone should go lick their wounds and be patient. Stalemate can't go on forever.

Politics: Fiona Hill delivered a prepared statement before the Q&A and like Vindman before her, said she was "an American by choice." These statements of patriotism and faith in the American system and values can be corny, but powerfully moving all the same, especially in contrast to the plug-ugly Republicans. Hill said that the fiction of Ukraine being the party that interfered in the 2016 election was devised by Putin; those Republicans who cling to the story are doing nothing but give aid to Russia.

She also said Sondland, at the direction of Trump and with the full knowledge of Giuliani, Pompeo, Mulvaney and Bolton, were "involved in a domestic political errand" that was increasingly at odds with the national security foreign policy. It took a while for Hill (and others) to get it, and when she did, was angry, telling Sondland it will "blow up"... and so it did. Note that Republicans Trump defenders do not deny any of it, although they are sticking to the "Ukraine wanted Hillary" stance.

They also embrace the theory that the president can do anything damn thing he wants in foreign policy, including withholding military aid from an ally at war, and never mind that Congress authorized it. He gets to "execute" it. This is a stance someone like Bolton would likely approve.

The story is clear and coherent. We repeat: nobody is denying it. And yet there are still gaps that could be easily filled by Giuliani (still peddling the not-Russia fable), Pompeo, Mulvany, and Bolton. Well, Perry and Pence, too, but they are both fairly dim. We really want to hear from John Bolton, who is being accused of wanting to save the good stuff for his book ($2 million advance!) instead of for the American people. If the president can do anything he wants—unlimited executive power—why are these guys not up there testifying? And what else are they covering up?

Trump won the election in part on his charge of "crooked Hillary," and was hoping to do the same thing with Crooked Joe Biden. Many got snookered by misinformation/disinformation about just how crooked Hillary was, and many more just stayed home because let's face it, Hillary is unappealing. As it turns out, Biden seems to be a sinking ship. How reckless to risk impeachment for such a fleeting political advantage that will not even be needed. The charges can easily outnumber Nixon's, according to impeachment expert, Harvard law prof Tribe. Bribery. Abuse of power. Obstruction of Congress. Violation of the oath of office. And maybe one or two more.

Meanwhile, in Israel former PM Netanyahu is going to stand trial for bribery, fraud and breach of trust. And Bibi is a whole lot smarter than Fat Crooked Donny and all his cronies put together.

Note to Readers: Next Thursday, Nov 28, is Thanksgiving. Again we note that the holiday celebrates the Indians that saved the early colonists from starvation, only to have the colonists massacre them and put them on barren reservations. With every new president we hope for something better, but even Obama let us down. Anyway, it's a holiday in the US and one of the big ones. We will not publish reports on Wednesday, Thursday or Friday of next week.

This is an excerpt from “The Rockefeller Morning Briefing,” which is far larger (about 10 pages). The Briefing has been published every day for over 25 years and represents experienced analysis and insight. The report offers deep background and is not intended to guide FX trading. Rockefeller produces other reports (in spot and futures) for trading purposes.

To get a free trial, please write to [email protected] and you will be added to the mailing list..

This morning FX briefing is an information service, not a trading system. All trade recommendations are included in the afternoon report.

Recommended Content

Editors’ Picks

EUR/USD clings to daily gains above 1.0650

EUR/USD gained traction and turned positive on the day above 1.0650. The improvement seen in risk mood following the earlier flight to safety weighs on the US Dollar ahead of the weekend and helps the pair push higher.

GBP/USD recovers toward 1.2450 after UK Retail Sales data

GBP/USD reversed its direction and advanced to the 1.2450 area after touching a fresh multi-month low below 1.2400 in the Asian session. The positive shift seen in risk mood on easing fears over a deepening Iran-Israel conflict supports the pair.

Gold holds steady at around $2,380 following earlier spike

Gold stabilized near $2,380 after spiking above $2,400 with the immediate reaction to reports of Israel striking Iran. Meanwhile, the pullback seen in the US Treasury bond yields helps XAU/USD hold its ground.

Bitcoin Weekly Forecast: BTC post-halving rally could be partially priced in Premium

Bitcoin price shows no signs of directional bias while it holds above $60,000. The fourth BTC halving is partially priced in, according to Deutsche Bank’s research.

Week ahead – US GDP and BoJ decision on top of next week’s agenda

US GDP, core PCE and PMIs the next tests for the Dollar. Investors await BoJ for guidance about next rate hike. EU and UK PMIs, as well as Australian CPIs also on tap.