The GBP/USD stayed comatose around 1.4940 levels in the European session on Thursday even though the UK PMI manufacturing number printed higher than estimate. The pair spiked in the early US session on a broad based USD sell-off triggered by a sharp rise in the EUR/USD pair. EUR bears were left disappointed by the “not so dovish†stance of the ECB.

The main event for the day is the US December non-farm payrolls discussed here (GBP/USD Forecast: Non-farm Payrolls impact on GBP/USD)

Technicals – support at 1.5518

· Sterling rose above the trend line resistance (red) at 1.5060 and 1.5087 (61.8% of Apr-Jun rally). The pair also rose above the expanding channel (marked by green lines) seen on the hourly chart. Thus, an immediate support is seen at 1.5118 (channel support). · Given the overbought RSI on the hourly chart and the likelihood of the GBP selling in EUR/GBP cross (after hawkish ECB), the GBP/USD pair could dip below 1.5118 and test 1.5087 (61.8% Apr-Jun rally). · So long as the pair stays above 1.5087, the probability of a spike to 1.52 levels on a weaker-than-expected NFP (below 170) is high. · In case, the NFP blows past expectations, the currency pair could take out the falling trend line support (red) at 1.5045 and dip to 1.50 handle.

EUR/USD: Bulls could gain complete control on weak NFP and higher oil prices

The EUR/USD pair witnessed its largest single day gains since 2009. A bout of profit taking in the EUR shorts after ECB’s deposit cut rate soon translated into a full fledged rally after the ECB left the size of the QE program unchanged and merely expanded the maturity to end-March 2017.

Was ECB dovish?

Not really, but Draghi’s repeated jawboning of the EUR in last one month or so had heightened expectations to the point where the likelihood of the bank falling short of expectations was high, and that is what happened.

A cut in the deposit rate makes more bonds eligible for purchases under the ECB’s QE program. The extension of the maturity normally would have made the EUR bears happy. But again, the markets were expecting an increase in the size, which did not come through.

ECB excelled at exchange rate management again

After the surprisingly dovish tone of the September FOMC statement, there were increasing calls for a spike in the EUR/USD pair to 1.18-1.20 levels by year end. There was also a possibility that US Sep and Oct payrolls print horrible weak and further kill the Fed rate hike bets. In such a case, the EUR/USD pair could have easily rallied above 1.20 levels; making matters worst for the ECB.

However, Draghi, at the October meeting, hinted at more easing in December. His repeated jawboning pushed the EUR/USD to near yearly lows and there were increasing calls for parity by the year end. Now with the Fed on track to raise rates the ECB has little reason to worry, since profit taking on the EUR shorts alone may not result in the EUR/USD rallying way above 1.20; as it could have done if there was not jawboning of the EUR in last one month.

This also bodes well for the Fed, since the correction in the EUR/USD pair and a possibility of correction in crude could keep the USD on the back foot across the board. So the Fed does not have to worry about a fresh rally in the USD, following the liftoff at the December meeting.

As for today, the main event is NFP and its impact on the EUR/USD pair is discussed here Nonfarm Payrolls: does it really matter now?).

OPEC and EUR/USD

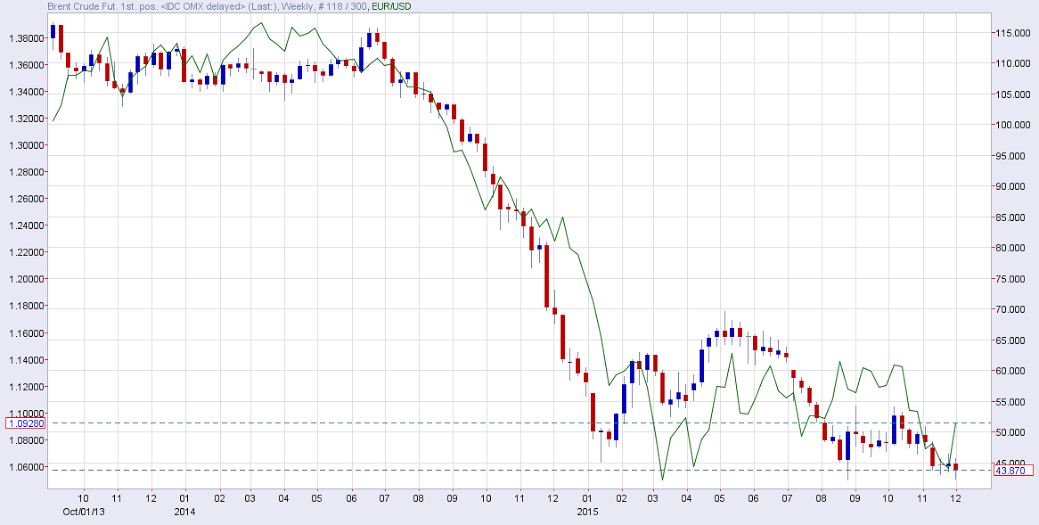

The other event – OPEC meeting could make the EUR bulls happy, if Saudi hints at a possible cut in the production in the near future. Eurozone’s HICP inflation is more sensitive to crude prices and thus, oil prices and the EUR/USD pair have had a strong direct correlation since July 2014.

Brent Oil and EUR/USD chart

Overall the comparison chart suggests, oil prices may form a double bottom and that would make the EUR bulls happy. Fed too would cheer a recovery in oil prices as it would keep the USD weak against the major economies (battling with deflation)

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

EUR/USD keeps the red near 1.0500 amid market caution ahead of US CPI

EUR/USD holds losses near 1.0500 in the European session on Wednesday. The pair faces headwinds from a cautious market mood and resurgent US Dollar demand, as traders expect an uptick in the US inflation data that could impact the Fed's easing trajectory while the ECB remains on track for more rate cuts.

GBP/USD drops below 1.2750, awaits US inflation data

GBP/USD is back in the red below 1.2750 in European trading on Wednesday. The Pound Sterling loses traction amid renewed US Dollar buying as risk sentiment worsens heading into the key US CPI showdown. The US inflation data is key to gauging the pace of Fed's future rate cuts.

Gold price steadies below $2,700 as traders seem reluctant ahead of US inflation data

Gold price seems to have stabilized following good two-way intraday price swings and currently trades around the $2,690 area, below a two-week high touched earlier this Wednesday. Expectations that the Fed will adopt a cautious stance on cutting rates continue to push the US Treasury bond yields.

US CPI set to grow at faster pace in November, edging further away from Fed target

The US Consumer Price Index report for November, a key measure of inflation, will be unveiled at 13:30 GMT by the Bureau of Labor Statistics. Markets are buzzing in anticipation, as the release could trigger significant swings in the US Dollar and influence the Federal Reserve's plans for interest rates in the months ahead.

How the US-China trade dispute is redefining global trade

Since Donald Trump took office in 2017, trade flows and market shares have changed substantially. We think that shift is set to continue under looming tariffs and a new protectionist environment.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.