![]()

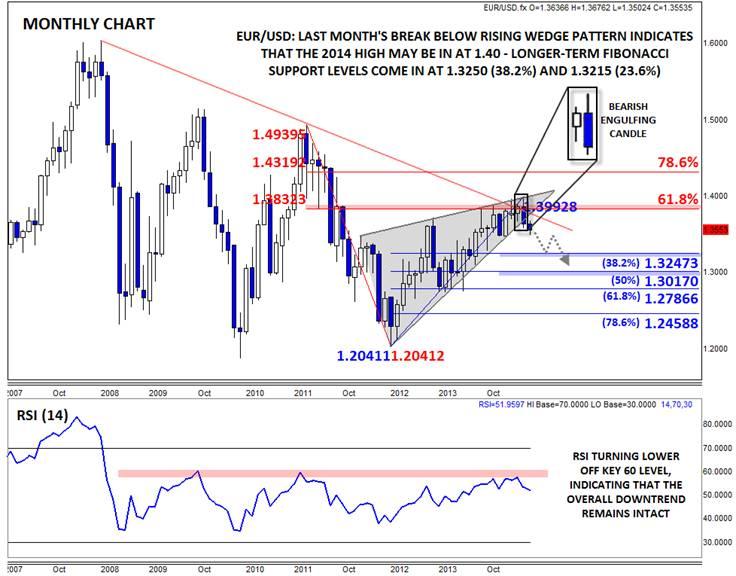

Given all the recent excitement surrounding the EURUSD, traders have been hyper-focused on trading the day-by-day and hour-by-hour swings. However, when high-impact, unprecedented developments come into play (and I’d definitely consider a major central bank opting for a negative deposit rate for the first time in history to be a massive event), it’s important to take a step back and look at a long-term chart. The monthly chart shows a number of bearish technical indications that suggest the EURUSD may have put in a major top around 1.40, and that the pair may generally fall for the rest of the year.

The first pattern that pops out after even a cursory look at the EURUSD’s monthly chart is the 2.5-year rising wedge pattern. Despite the seemingly bullish name, this price action pattern shows that buyers are struggling to push the price higher on each subsequent swing. It is a classic sign of waning buying pressure and points to a big drop once the lower trend line is broken.

While a single pattern alone could easily be shrugged off by euro bulls, the confluence of other bearish technical signs augur for more caution. For one, last month’s high came in directly at converging resistance from a six-year bearish trend line and the 61.8% Fibonacci retracement of the 2011-12 drop. In addition, the pair put in a clear Bearish Engulfing Candle* last month; this formation indicates a strong shift from buying to selling pressure and is often seen at major tops in the market. Finally, the EURUSD’s monthly RSI stalled out and is turning lower off the “60†level, keeping the indicator in bearish territory.

This rare confluence of bearish technical signs indicates that we may have seen the EURUSD’s 2014 high at 1.40 last month, and that rates may continue lower in the second half of the year. To the downside, patient traders may want to watch the Fibonacci retracements of the 2-year rally as possible targets, including 1.3250 (38.2%) and 1.3015 (50%). Of course, any outlook (and especially one so long-term in nature) should always be subject to revision; in this case, we’d have to seriously reconsider the long-term bearish outlook if rates bounce back toward 1.39.

*A Bearish Engulfing candle is formed when the candle breaks above the high of the previous time period before sellers step in and push rates down to close below the low of the previous time period. It indicates that the sellers have wrested control of the market from the buyers.

This research is for informational purposes and should not be construed as personal advice. Trading any financial market involves risk. Trading on leverage involves risk of losses greater than deposits.

Recommended Content

Editors’ Picks

AUD/USD consolidates near 19-month peak as traders await US PCE Price Index

AUD/USD oscillates in a range below the 0.6900 mark, as traders opt to move to the sidelines ahead of the US PCE Price Index. In the meantime, the RBA's hawkish stance, the optimism led by additional monetary stimulus from China, the prevalent risk-on mood, and a bearish USD continue to act as a tailwind for the pair.

USD/JPY holds above 145.00 after the Tokyo CPI inflation data

The USD/JPY pair attracts some buyers to near 145.20 on Friday during the early Asian session. The pair gains ground near three-week highs after the Tokyo Consumer Price Index. The attention will shift to the US Personal Consumption Expenditures Price Index for August, which is due later on Friday.

Gold price holds steady near record peak; looks to US PCE data from fresh impetus

Gold price consolidates below the all-time high set on Thursday amid overbought conditions on the daily chart and the risk-on mood, though dovish Fed expectations continue to act as a tailwind. Bulls, meanwhile, prefer to wait for the release of the US PCE Price Index before placing fresh bets.

Ethereum investors show bullish bias amid ETF inflows and positive funding rates, exchange reserves pose risk

Ethereum traded around $2,640 on Thursday, up more than 2% following increased bullish bias among investors, as evidenced by ETH ETF net inflows and an uptrend in funding rates. However, investors may be wary of a potential correction from ETH's rising exchange reserve.

RBA widely expected to keep key interest rate unchanged amid persisting price pressures

The Reserve Bank of Australia is likely to continue bucking the trend adopted by major central banks of the dovish policy pivot, opting to maintain the policy for the seventh consecutive meeting on Tuesday.

Five best Forex brokers in 2024

VERIFIED Choosing the best Forex broker in 2024 requires careful consideration of certain essential factors. With the wide array of options available, it is crucial to find a broker that aligns with your trading style, experience level, and financial goals.