The US GDP has already recovered from the pandemic recession. What’s next for the economy and the gold market?

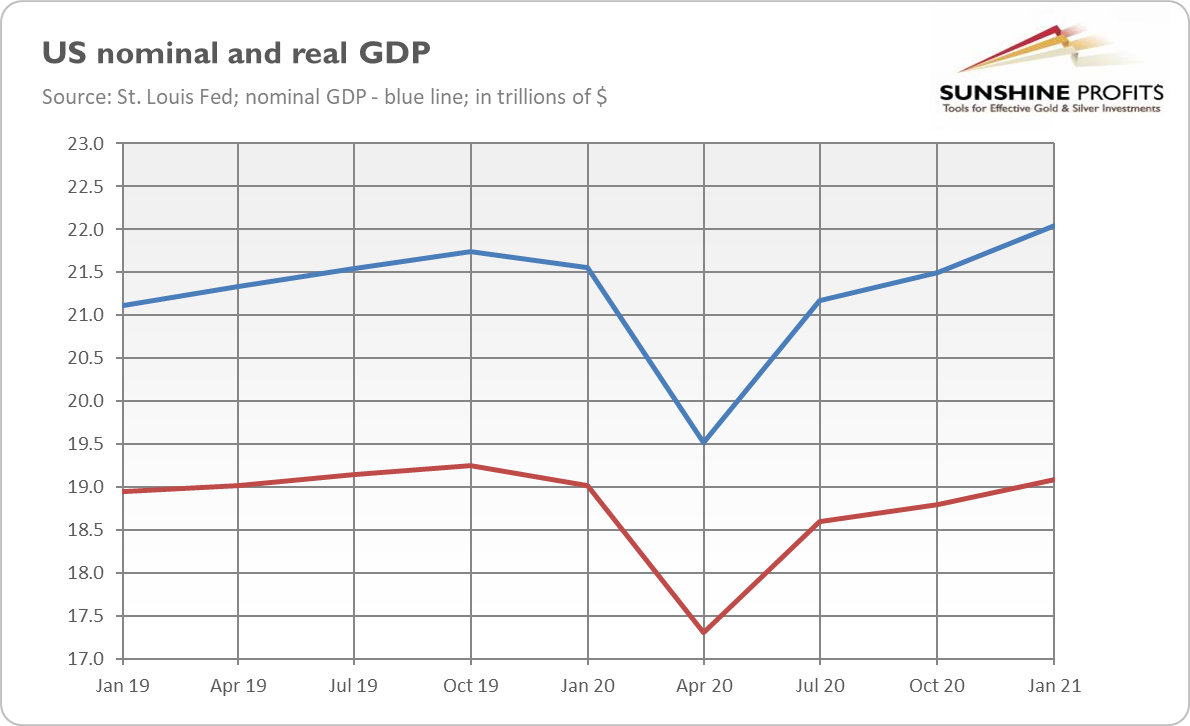

Ladies and Gentlemen, the economic crisis has ended. Actually, not only is the recession over but so is the recovery! This is at least what the recent GDP readings are indicating. As the chart below shows, the US nominal GDP has already jumped above the pre-pandemic level. The real GDP, which takes inflation into account, remained in the first quarter of 2021 below the size of the economy seen at the end of 2019, but it will likely surpass this level in the second quarter of the year.

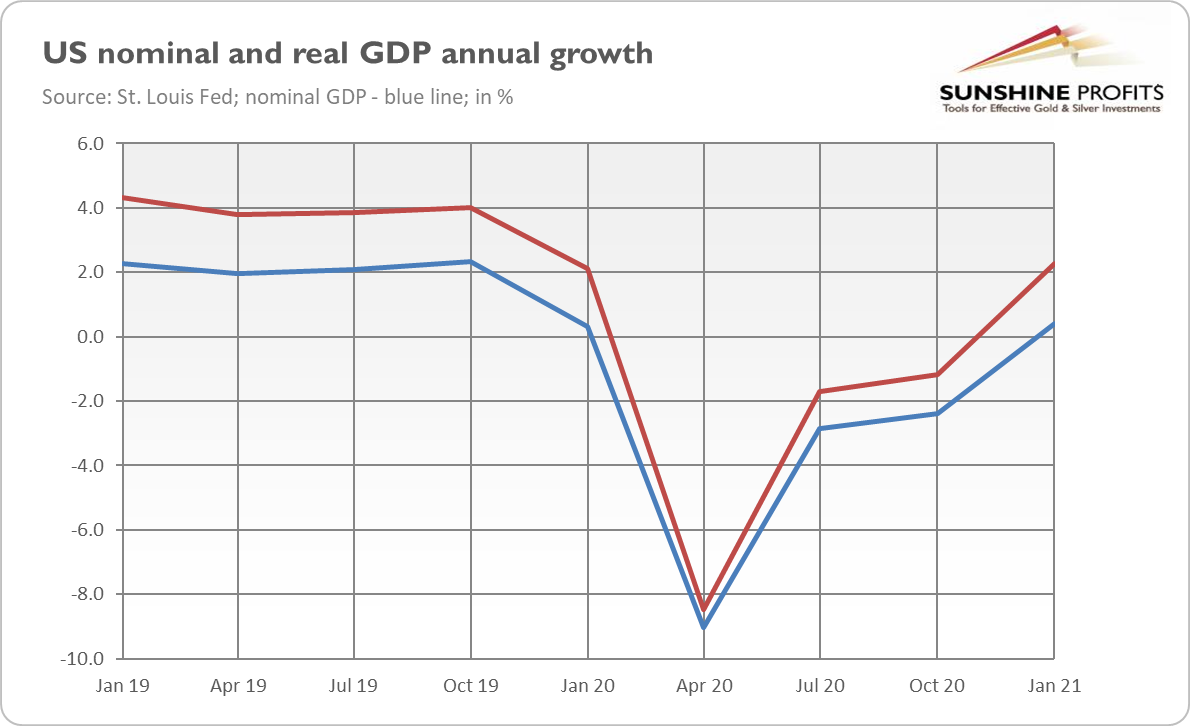

As one can see in the chart below, in terms of GDP growth, the situation is a bit worse, as the annual percentage changes are still below the pre-epidemic level. However, this should change in the second quarter of 2021 when the growth pace is likely to peak amid base effect and reopening of the economy.

So, the question is: what’s next? Will the economic boom become well-established or will we see a lot of volatility or even new slumps? Given the recent flux of disappointing high-frequency indicators that fell considerably short of expectations (just think about April’s nonfarm payrolls ), the question is very relevant.

Well, there are many threats to growth, that’s for sure. The first is, of course, the ever-evolving coronavirus and its new variants. However, judging by preliminary evidence, the vaccines should remain effective, allowing economies to function freely.

The second obvious danger is clearly the economy overheating and higher inflation. The Fed and the Congress injected a lot of liquidity into the economy although it would recover if it was left to its own devices thanks to the rollout of vaccinations and easing lockdowns. So, much of government funds arrived just when the economy practically recovered, which is a recipe for higher prices and inflation-related turbulences in the financial markets.

Third, the increase in debt – both private and public – makes the global economy more fragile. Given the level of indebtedness, even small increases in real interest rates would be dangerous. They would increase the costs of servicing debts for the governments and could hit the asset prices. The fact that the Fed will be under great pressure to remain very dovish is, of course, positive for gold prices. Even if we see some effort to normalize the monetary policy, interest rates and the Fed’s balance sheet will never return to the pre-recession levels.

Last but not least, there is a threat of financial crisis. Many people are worried that there is a bubble in the stock market (and in other markets as well, such as the cryptocurrency market). Indeed, the equities have been reaching new peaks and the valuations are elevated. The margin debt has also jumped. Not surprisingly, the relative frequency of Google searches for the “stock market bubble” has recently risen (just as for the word “inflation”).

Even the Fed in its latest Financial Stability Report expressed some concerns. This is what the Fed Governor Lael Brainard said in a statement linked to the report :

Vulnerabilities associated with elevated risk appetite are rising. Valuations across a range of asset classes have continued to rise from levels that were already elevated late last year. Equity indices are setting new highs, equity prices relative to forecasts of earnings are near the top of their historical distribution, and the appetite for risk has increased broadly, as the "meme stock" episode demonstrated. Corporate bond markets are also seeing elevated risk appetite, and the spreads of lower quality speculative-grade bonds relative to Treasury yields are among the tightest we have seen historically. The combination of stretched valuations with very high levels of corporate indebtedness bear watching because of the potential to amplify the effects of a re-pricing event.

To sum up, the US economy has already recovered from the coronavirus recession, which is bad for safe-haven assets such as gold, as the yellow metal doesn’t like economic expansions. However, there are important threats to sustainable economic growth, which should support the price of gold.

Actually, there is still room for gold to rally further. This is because we are in an inflationary phase of the economic expansion (this boom will be more inflationary than the post- Great Recession period), and all the money created during the pandemic has flowed into the asset markets, pushing their prices into elevated levels not necessarily justified by fundamentals (just think about Dogecoin). Gold could benefit from such a bubble, as well as from an inflationary and hot environment.

Want free follow-ups to the above article and details not available to 99%+ investors? Sign up to our free newsletter today!

All essays, research and information found above represent analyses and opinions of Przemyslaw Radomski, CFA and Sunshine Profits' employees and associates only. As such, it may prove wrong and be a subject to change without notice. Opinions and analyses were based on data available to authors of respective essays at the time of writing. Although the information provided above is based on careful research and sources that are believed to be accurate, Przemyslaw Radomski, CFA and his associates do not guarantee the accuracy or thoroughness of the data or information reported. The opinions published above are neither an offer nor a recommendation to purchase or sell any securities. Mr. Radomski is not a Registered Securities Advisor. By reading Przemyslaw Radomski's, CFA reports you fully agree that he will not be held responsible or liable for any decisions you make regarding any information provided in these reports. Investing, trading and speculation in any financial markets may involve high risk of loss. Przemyslaw Radomski, CFA, Sunshine Profits' employees and affiliates as well as members of their families may have a short or long position in any securities, including those mentioned in any of the reports or essays, and may make additional purchases and/or sales of those securities without notice.

Recommended Content

Editors’ Picks

EUR/USD rises toward 1.0700 after Germany and EU PMI data

EUR/USD gains traction and rises toward 1.0700 in the European session on Monday. HCOB Composite PMI data from Germany and the Eurozone came in better than expected, providing a boost to the Euro. Focus shifts US PMI readings.

GBP/USD holds above 1.2350 after UK PMIs

GBP/USD clings to modest daily gains above 1.2350 in the European session on Tuesday. The data from the UK showed that the private sector continued to grow at an accelerating pace in April, helping Pound Sterling gather strength.

Gold price flirts with $2,300 amid receding safe-haven demand, reduced Fed rate cut bets

Gold price (XAU/USD) remains under heavy selling pressure for the second straight day on Tuesday and languishes near its lowest level in over two weeks, around the $2,300 mark heading into the European session.

Here’s why Ondo price hit new ATH amid bearish market outlook Premium

Ondo price shows no signs of slowing down after setting up an all-time high (ATH) at $1.05 on March 31. This development is likely to be followed by a correction and ATH but not necessarily in that order.

US S&P Global PMIs Preview: Economic expansion set to keep momentum in April

S&P Global Manufacturing PMI and Services PMI are both expected to come in at 52 in April’s flash estimate, highlighting an ongoing expansion in the private sector’s economic activity.