- GBP/USD has been boosted by Brexit calm and clearer Fed path.

- UK inflation, the energy crunch and US politics are set to rock markets.

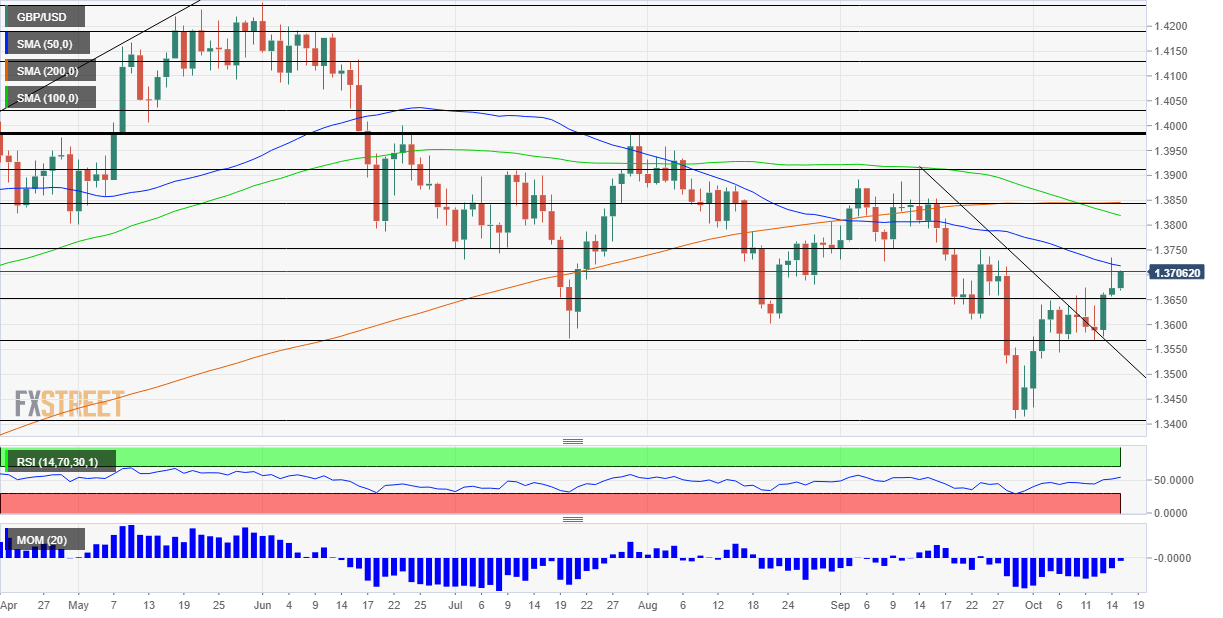

- Mid-October's daily chart shows bears are holding onto their lead.

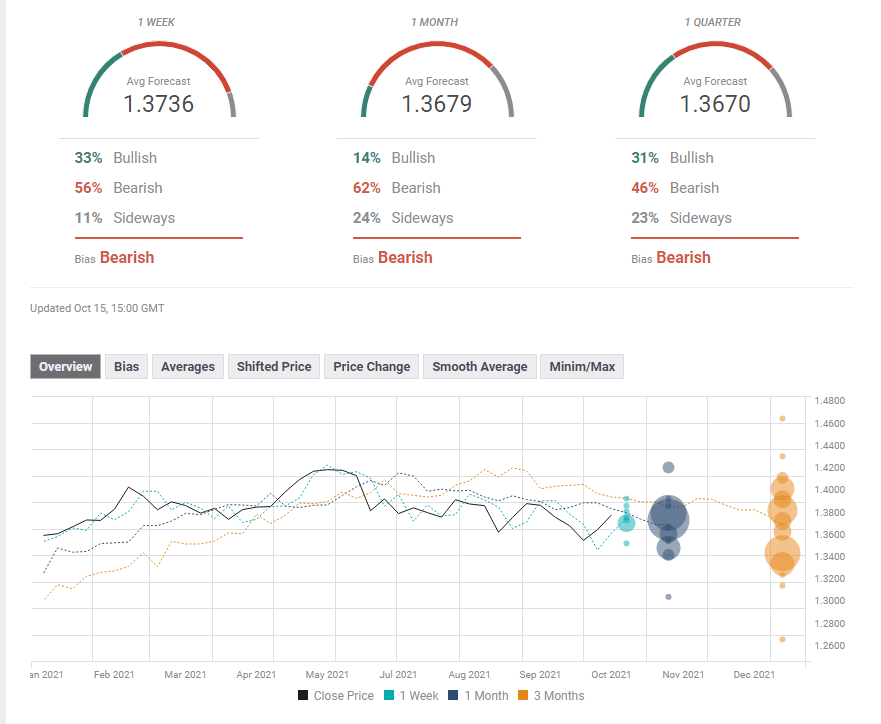

- The FX Poll is pointing to a reversal of recent gains.

Brexit tends to pound the pound – but now, relatively soothing news has helped send sterling higher. Alongside a moderate tapering path from the Fed, inflation concerns failed to stop cable's climb. UK inflation stands out, as it could determine the BOE's next decision.

This week in GBP/USD: Brexit comeback and US inflation dominate

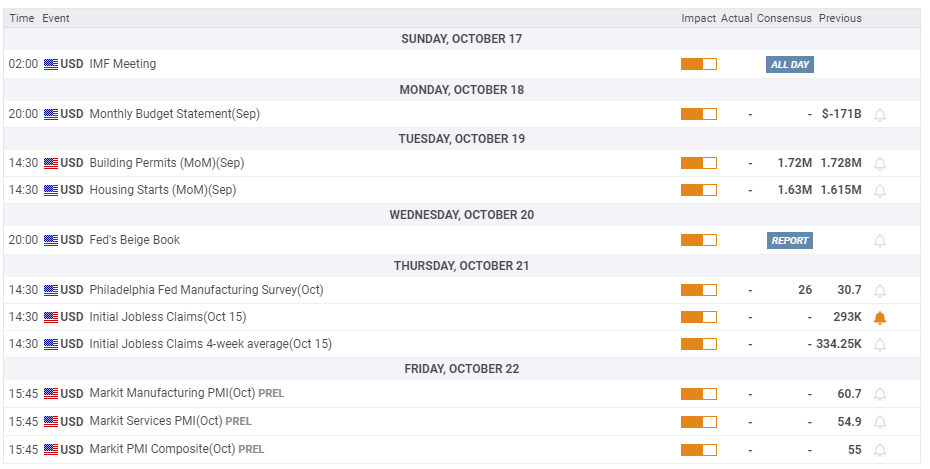

Earlier this week markets were confused by US inflation which showed the headline Consumer Price Index beating estimates with a 5.4% YoY rise, but Core CPI remaining stable at 4% in September. The generally elevated levels initially boosted the dollar, but a subsequent fall in yields sent the dollar back down.

Fed officials gave mixed messages around inflation: while Vice-Chair Richard Clarida said it would fade, Atlanta Fed President Raphael Bostic seemed to think it would stick.

The FOMC Meeting Minutes, however, helped clarify the picture, leaving less room for mystery – the Fed laid down a timeline for beginning the tapering process, starting in mid-November and ending it within eight months. The bank explicitly said that it intends to reduce its purchases by $15 billion per month. Some expected $20 billion.

This relatively moderate pace weighed on the dollar and provided some clarity.

US Retail Sales beat estimates with an increase of 0.7% in September – far above 0.2% projected and on top of upward revisions. Core figures exceeded expectations as well. The good news from the US consumer only temporarily halted cable's advance.

UK data has been primarily pound-positive. Britain's Unemployment Rate dropped to 4.5% in August, while wage growth surprised with a leap to 7.2% YoY when excluding bonuses. While manufacturing output advanced by 0.5% compared with projections for a no-change outcome, monthly Gross Domestic Product (GDP) data for August missed estimates with 0.4%.

Nevertheless, the Bank of England is advancing toward raising interest rates – and it may come as soon as November's meeting. BOE Governor Andrew Bailey hinted that rising inflation would warrant lifting borrowing costs.

Brexit themes persist: David Frost, who leads the topic of the UK's EU exit, laid out his government's objection to having any customs checks between Northern Ireland and Great Britain, contrary to the accords. Frost negotiated the Brexit deal. Fears of an outright trade war between Britain and the bloc.

Brussels also offered some concessions, however, and discussions continued – thus keeping the pound bid despite the disagreement.

Politics on the other side of the pond also remained of significance.

Debt ceiling debacle: Congress averted an unimaginable US default by kicking the debt ceiling down the road – but only to early December. Markets seemed to be pleased with this breathing room, however, pushing the safe-haven dollar down.

The time lawmakers bought should also allow Democrats to sort out how they want to proceed with President Joe Biden's infrastructure bills. Centrist members of the party seem to be accepting a topline of some $2 trillion, but that remains far from the original $3.5 trillion for the partisan plan. The smaller, bipartisan scheme hinges on agreeing on both programs.

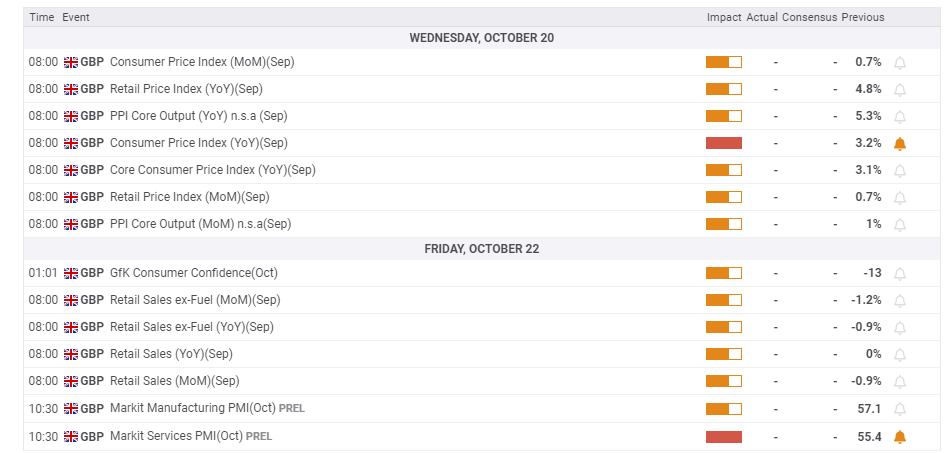

UK events: Further Brexit clashes and UK inflation

Will the EU and the UK put Brexit on the backburner? Market observers seem resigned to accept that the topic will linger for a long time – but there is a difference between making the headlines and being a side story. If quiet negotiations replace pompous speeches, sterling could shine. On the other hand, ongoing clashes could pressure the pound.

Contrary to the continent, COVID-19 infections refuse to fall in Britain, but the disease's impact on markets is diminished. Any seasonal change in cases or hospitalizations could weigh on the pound.

After US inflation rocked markets, the UK's turn has come – and it is critical for the BOE's upcoming decision. Headline inflation shot to 3.2% YoY in August, above the bank's 1-3% range.

If price rises remain elevated, there is room for substantial gains for sterling, as a rate hike in November would seem imminent. A drop below 3% would provide relief to the BOE and could take some of the hot air out of the pound.

Here is the list of UK events from the FXStreet calendar:

US events: Infrastructure talks, Fed Beige Book and more

No news is good news when it comes to Brexit – but what about US politics? After the debt ceiling issue was delayed, Democrats have time to sort out how they want to move forward with the duo of expenditure bills.

The bipartisan infrastructure bill does not require more negotiation, but it is dependent on passing a broader spending deal still under negotiation. Will leftist Democrats climb down from $3.5 trillion? Will centrist Dems climb up from $1.5 trillion? The lack of news implies negotiations are moving forward. Any deal could boost sentiment, while the absence of an accord would weigh on the market mood.

The Federal Reserve's "Beige Book" is usually a gray affair – but not this time. With two weeks to go until the probable taper announcement, the document's anecdotal evidence about rising prices could push policymakers into a faster reduction in purchases than the Fed minutes suggested. Signs of easing in bottlenecks would contribute to some calm and weigh on the dollar.

Apart from the Beige Book, housing figures are of interest as the sector remains hot, and investors will also see if jobless claims remain under 300,000. Last but not least, Markit's preliminary PMIs for October will garner attention – especially around their comments on inflation. Back in September, manufacturing topped 60 points, reflecting strong growth, while services were around 55, representing moderate yet solid expansion.

Here are the upcoming top US events this week:

GBP/USD technical analysis

Pound/dollar has advanced above the downtrend resistance line discussed here in the previous week, and downside momentum has been waning. On the other hand, the currency pair failed to surpass the 50-day Simple Moving Average. Another bearish development is the fact that the 100-day SMA crossed the 200-day SMA to the downside. All in all, there is somewhat more room to the downside.

Support awaits at 1.3650, which capped cable in early October. A more significant cushion is 1.3580, which was a swing low in July and also held the pair up in mid-October. Further down, 1.34 and 1.3310 come into play.

Some resistance awaits at 1.3750, which was a swing high in late September. It is followed by 1.3840, which is where the 200-day SMA hits the price. Further above, 1.3910 is eyed.

GBP/USD sentiment

Supply chain issues are exacerbated by Brexit, and they have likely pushed inflation higher. If markets price in a BOE rate hike in November, GBP/USD has room to rise regardless of dollar moves.

The FXStreet Forecast Poll is showing that experts foresee GBP/USD reversing its gains in the short run, extending those falls later on and stabilizing below 1.37 in the long term. While the upcoming week's forecast has been upgraded, those for the medium and longer terms remain stable. Mean reversion is the name of the game according to the poll.

Related reads

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

EUR/USD clings to daily gains above 1.0650

EUR/USD gained traction and turned positive on the day above 1.0650. The improvement seen in risk mood following the earlier flight to safety weighs on the US Dollar ahead of the weekend and helps the pair push higher.

GBP/USD recovers toward 1.2450 after UK Retail Sales data

GBP/USD reversed its direction and advanced to the 1.2450 area after touching a fresh multi-month low below 1.2400 in the Asian session. The positive shift seen in risk mood on easing fears over a deepening Iran-Israel conflict supports the pair.

Gold holds steady at around $2,380 following earlier spike

Gold stabilized near $2,380 after spiking above $2,400 with the immediate reaction to reports of Israel striking Iran. Meanwhile, the pullback seen in the US Treasury bond yields helps XAU/USD hold its ground.

Bitcoin Weekly Forecast: BTC post-halving rally could be partially priced in Premium

Bitcoin price shows no signs of directional bias while it holds above $60,000. The fourth BTC halving is partially priced in, according to Deutsche Bank’s research.

Week ahead – US GDP and BoJ decision on top of next week’s agenda

US GDP, core PCE and PMIs the next tests for the Dollar. Investors await BoJ for guidance about next rate hike. EU and UK PMIs, as well as Australian CPIs also on tap.