- GBP/USD has jumped on better UK figures amid rising uncertainty.

- The all-important BOE decision and the Fed decision take center stage.

- Late January's daily chart is painting a mixed picture.

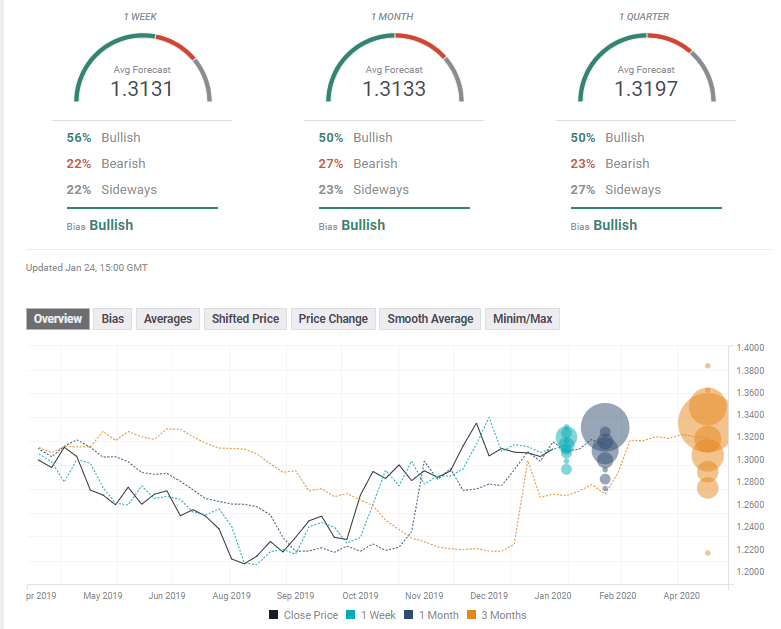

- The FX Poll is showing that experts are bullish on all timeframes.

Upbeat data has lowered the chances of a rate cut, a decision that is on a knife's edge. The Bank of England is left, right and center, but the Fed decision and other events may also have a significant impact.

This week in GBP/USD: Upbeat data, coronavirus fears

After a streak of disappointing figures, the UK jobs report provided a positive surprise with wages holding onto a yearly gain of 3.2% in November. It was followed by an upbeat Industrial Trends statistic from the Confederation of British Industry – a figure that also surprised traders by triggering a rally in sterling.

The last substantial release came from Markit. Its Purchasing Managers' Indexes both exceeded estimates, further casting doubt about a cut by the BOE. However, the manufacturing figure is still pointing to contraction in the sector.

GBP/USD volatility considerably increased as speculation mounted. US dollar movements also had their share in rocking the currency pair. The greenback was affected by fears of the coronavirus outbreak.

While the World Health Organization (WHO) refrained from declaring a global emergency, Chinese authorities shut down transport links to Wuhan and other cities where the SARS-like virus was most prominent. Fears of damage to the worldwide economy benefited the dollar, but it was not a one-way street.

The House of Lords gave the final seal of approval the Withdrawal Bill, allowing the UK to leave the EU on January 31 as expected. The focus remains on future EU-UK relations. Prime Minister Boris Johnson reiterated his position about reaching a deal with the bloc by year-end, despite doubts from Brussels. The topic was on the sidelines amid BOE speculation.

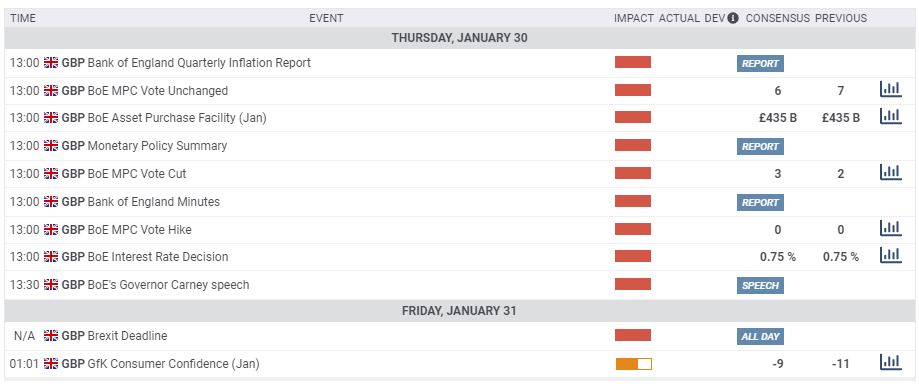

UK events: BOE left, right, and center

The central bank's decision dominates the UK economic calendar. The consensus of economists is pointing to the BOE holding rates, but bond markets see it as a coin flip. Apart from the decision, the level of support it receives is critical. The nine-strong Monetary Policy Committee will likely be split in any case. Mark Carney, the outgoing Governor of the BOE, may find himself in the minority in his last rate event before passing the baton to Andrew Bailey.

The "Old Lady" will also convey a message about future decisions, and that may whipsaw the pound. A "hawkish cut" or a "dovish hold" – signaling the opposite of the decision – cannot be ruled out.

For all the details, see BOE Preview: Carney to cause carnage with a hawkish cut? Four scenarios for GBP/USD

The UK Brexits on the following day, but retains most of its rights and obligations within the EU until year-end. Headlines about the historic day and perhaps Big Ben's bong will fill the papers, but markets are focused on the outcome of the post-transition agreements. Negotiations are yet to start.

Here is the list of UK events from the FXStreet calendar:

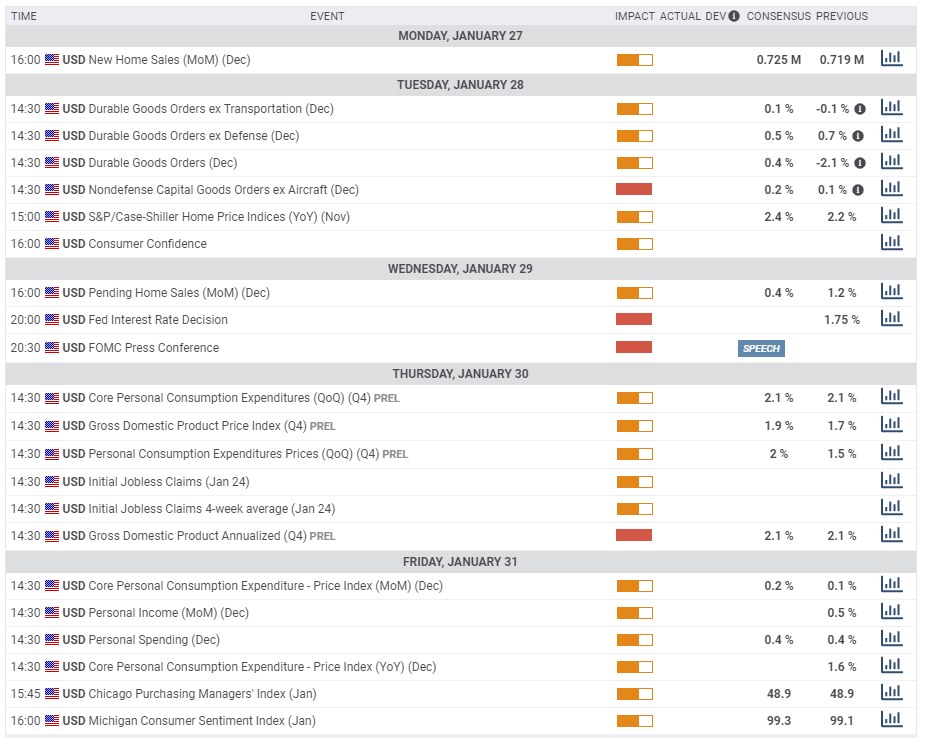

US events: Fed stands out

The US dollar will likely be impacted by coronavirus news, with worrying developments benefiting the greenback and hopeful headlines pushing it

New Home Sales kick off the week, and they are expected to remain at elevated levels in December. Durable Goods Orders, due out on Tuesday, will provide some insights on investment. Have they picked up as the US and China were nearing an accord? The data also feeds into growth figures due out later in the week.

The Federal Reserve's decision on Wednesday is the main event of the week. The Fed is expected to leave rates unchanged and continue signaling an extended pause. In its previous decision in December, the bank cut rates but also said that current levels are "appropriate." Since then, Fed officials have echoed this message while economic figures have been on the softer side, but uncertainty has dropped after the Sino-American trade deal.

While the Fed will try not rocking the boat, markets will be scrutinizing every word in the rate statement and the accompanying press conference by Jerome Powell, Chairman of the Federal Reserve.

See Fed Preview: Five things that will determine the dollar's direction

The first read of Gross Domestic Product figures for the fourth quarter of 2019 is predicted to show that growth is close to 2,1% annualized seen in the third quarter. The initial release tends to surprise markets and trigger volatility. Improvement in business investment is also of high interest to markets as well as trade figures within the GDP report.

The Fed's preferred gauge of inflation, the Core Personal Consumption Expenditure (Core PCE) will probably remain around 1.6% in the read for December – below the bank's 2% target. It is published alongside other significant statistics such as Personal Consumption and Personal Spending.

Overall, the Fed and GDP stand out in the last week of January.

Here the upcoming top US events this week:

GBP/USD Technical Analysis

Pound/dollar has recaptured the 50-day Simple Moving Average and continues trading above the 100 and 200-day SMAs. However, upside momentum has disappeared. The Relative Strength Index is balanced.

Overall, bulls are in the lead.

GBP/USD faces a resistance area around 1.3150-13170. Both levels capped it during January. Further up, 1.3210 held it down in early January, and 1.3285 was the Christmas week peak. Next, 1.3420 and 1.3510 await the currency pair.

Support awaits at 1.3085, which worked as support in late January. It is followed by 1.3035, which capped cable in late December and provided support in January. It is followed by 1.2950, a double bottom that was seen in recent months.

It is essential to note that high volatility during the BOE could push the pound through many levels only to see it snap back to the range.

GBP/USD Sentiment

It is hard to know what Carney and his colleagues are thinking, but cutting rates has marginally higher odds. That could send sterling down, but the move may stall if the bank signals a pause.

The FX Poll is showing a bullish bias in all timeframes. Are experts pricing out a BOE cut? Targets are barely changed from the previous week's poll and seem more cautious – on average – than recent sterling volatility.

Related Forecasts

- GBP/USD Price Forecast 2020: Pound may continue to fall on hard Brexit deadline

- EUR/USD Forecast: After losing support, the Fed and GDP figures to determine next moves.

- USD/CAD Forecast: Welcome to the statistical derby

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

EUR/USD clings to daily gains above 1.0650

EUR/USD gained traction and turned positive on the day above 1.0650. The improvement seen in risk mood following the earlier flight to safety weighs on the US Dollar ahead of the weekend and helps the pair push higher.

GBP/USD recovers toward 1.2450 after UK Retail Sales data

GBP/USD reversed its direction and advanced to the 1.2450 area after touching a fresh multi-month low below 1.2400 in the Asian session. The positive shift seen in risk mood on easing fears over a deepening Iran-Israel conflict supports the pair.

Gold holds steady at around $2,380 following earlier spike

Gold stabilized near $2,380 after spiking above $2,400 with the immediate reaction to reports of Israel striking Iran. Meanwhile, the pullback seen in the US Treasury bond yields helps XAU/USD hold its ground.

Bitcoin Weekly Forecast: BTC post-halving rally could be partially priced in Premium

Bitcoin price shows no signs of directional bias while it holds above $60,000. The fourth BTC halving is partially priced in, according to Deutsche Bank’s research.

Week ahead – US GDP and BoJ decision on top of next week’s agenda

US GDP, core PCE and PMIs the next tests for the Dollar. Investors await BoJ for guidance about next rate hike. EU and UK PMIs, as well as Australian CPIs also on tap.

-637154722031961863.png)