- Five financial bubbles are looming and may burst in 2020.

- Each one may have a different impact on the US dollar.

- The direction of travel depends on the magnitude.

The highest market volatility happens when bubbles burst – but which one will it be? The froth in the housing market that led to the Great Recession is unlikely to return, but five other bubbles loom over financial markets.

The reaction in the US dollar depends on the size of each market – and the magnitude of the burst. Generally, the deflating of a smaller, domestic bubble may weigh on the US economy and weaken the dollar. The Federal Reserve may cut interest rates to ease the local pain, which is unlikely to leave American shores.

However, when a more significant sector of the economy – at home or abroad – begins collapsing, the greenback may rise amid safe-haven flows. It is essential to remember that the Japanese yen tends to outperform the buck in times of trouble, but the dollar has ample room to beat other currencies such as euro, pound, or commodity currencies.

Here are the five bubbles that may burst in 2020, starting from the smallest to the largest one.

1) Student loans – Growing problem

Size: $1.41 trillion in 2019, and an increase of 6% from 2018 and 33% since 2014.

Obtaining a worthy college or university degree is becoming more expensive, while the payout – the post-studies salaries – has diminished. In 2018, the average student loan balance reached a record above $35K. No less than 54% of students take on debt and 14.4% of adults have a student loan. The delinquency rate, measured at the amount of debt which is at least 90 days overdue stands at 10.8%.

Student debt is already weighing on the economy as it limits disposable income and also delays family formation and home buying. It is harder to get rid of this kind of debt.

A classic burst of this bubble has low chances in 2020, but the growing issue and the rise in delinquencies related to studies may adversely impact the economy.

If the issue worsens, it could increase the chances that the Federal Reserve cuts rates, weighing on the US dollar.

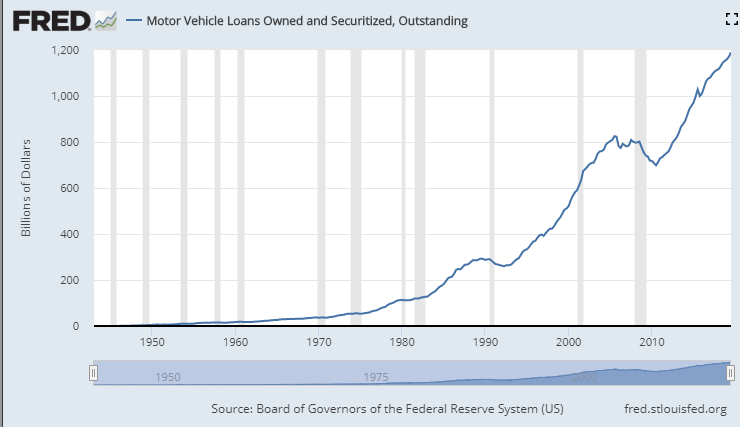

2) Auto loans - Easier bubble to burst

Size: $1.18 trillion

Source: Saint Louis Fed

Americans like shiny new cars. The Obama-era program “cash for clunkers” has decimated the number of old autos on America’s roads. However, new cars cost more and loans have grown substantially.

While the total debt for automobile loans is smaller than student loans, it can burst at a quicker pace. If more and more lenders default on their payments, it could hurt the car industry which is already struggling amid fierce competition.

While sums of over a trillion seem large, it is still small change in comparison to other asset classes such as housing debt. A burst of this bubble may also trigger rate cuts to solve a local US problem, thus weighing on the dollar without any global impact.

3) Tech stocks - Too much froth?

Size: $4.723 trillion is the market capitalization of stocks in the FANG+ index. These are Facebook, Apple, Amazon, Netflix, Google, Alibaba, Baidu, NVidia, Tesla, and Twitter.

The more limited group of FAANG stocks is up 700% from 2013 while the S&P is only 100% higher. While these businesses have grown rapidly, are these valuations justified? How large can a company grow?

Share prices of recently-listed companies have plunged. Examples include Slack, Uber and Lyft. Most notoriously, WeWork was forced to shelve its IPO.

Despite high multiples, the large companies’ stocks have been shielded from massive sell-offs, but not from the ire of the public, regulators and politicians. The Cambridge Analytica scandal has put Facebook’s Mark Zuckerberg on the hot seat in Congress and Google has been coming under greater scrutiny in Europe.

Concerns about privacy in Facebook’s case and monopoly over search in Google’s case have dimmed these companies’ prospects. Some are worried about Amazon’s environmental and monopolistic damage.

In 2020, the heat may rise and hit a boiling point. Calls to regulate tech firms’ activities or break them up may rise as the US Presidential Elections become fiercer. At some point, share prices may take more significant hits. If the “techlash” turns into a panicked sell-off, global markets could fall as well.

As tech stocks carry significant weight and impact broader markets, a massive plunge may send traders to the safety of the US dollar, as well as the Japanese yen and gold.

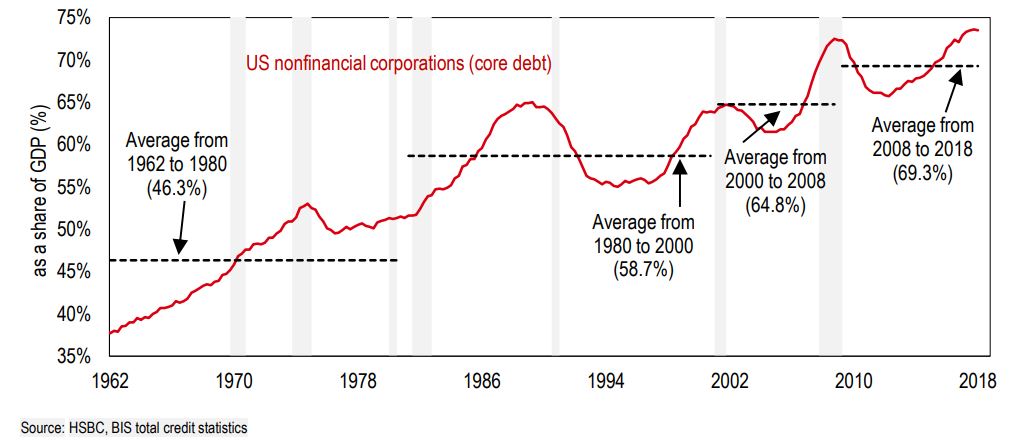

4) US corporate debt – a Global meltdown

Size: Around $10 trillion, 47% of US GDP

Source: MarketWatch

Source: MarketWatch

Interest rates have been low for over a decade, making lending cheaper. Some of the extra debt has gone into stock buybacks. The International Monetary Fund has already warned that the high corporate leverage may lead to a shock – deleveraging that may trigger a sell-off, depressing investment, and rising joblessness.

The debt to assets ratio for all nonfinancial companies that are publicly traded has already hit its highest levels in two decades.

The most worrying part of corporate debt is those bonds that are rated BBB. These are the lowest investment-grade assets and if they are downgraded – asset managers may be forced to sell them in order to meet obligations to stakeholders. According to the Fed, the amount of such debt is approaching an all-time high.

Quick downgrades of bonds from investment-grade to junk bonds may put high pressure on an already illiquid market. Moreover, in the case of a recession, 40% of total debt that is defined as at being at risk may rise to $19 trillion. Debt at risk is one held by corporations that are unable to cover interest expenses with their profits.

US corporate is already a systemic risk, that would trigger a risk-off reaction – a stronger US dollar, Japanese yen, and gold.

5) Chinese SOE debt – the biggest elephant, but it can kept under control

Size: Around $19 trillion in 2018.

State-Owned Enterprises (SOEs) play a crucial role in the centrally managed Chinese economy. Debt held by these companies – that vary from firms fully owned by the state to ones that are publicly traded – was been considered safe until a few years ago.

However, authorities in Beijing have become concerned about the moral hazard associated with the fact that these companies are shielded from defaults. Moreover, some have turned into “zombie” corporations that extend their unproductive existence and hinder growth.

The search for dynamism has led the world’s second-largest economy to allow for defaults. Moreover, the slowdown – caused by the trade war with the US among other factors – has also added pressure on indebted companies.

The process is likely to extend into 2020, with more SOEs defaulting on debt payments. The $19 trillion question is – will the process remain orderly or will it get out of control and trigger a broader sell-off in Chinese markets. The worst-case scenario is that significant defaults by SOEs causes capital outflows out of China, wreaking havoc all over the world.

If Chinese SOE debt defaults are severe, the global economy could suffer and the safe-haven dollar, yen and gold will have room to rise.

However, the likelihood of such a devasting development is low. The authorities have been able to engineer a soft landing of the economy and may continue doing so also in relation to SOE debt.

Overall, this is the largest bubble, but probably not the worse one to fear.

Conclusion

Among the five bubbles, the smaller American student and car debt loans may burst or deflate, but the damage will likely be local, weighing on the economy and the dollar. An implosion of the tech stock or corporate debt bubbles could damage the global economy and trigger safe-haven flows boosting the safe-haven greenback. Finally, Chinese SOE debt – the largest of all – may have an even worse effect on the world, but is unlikely to deflate in a severe manner.

This article belongs to the 20 trading ideas for 2020 series. Check the full list of 2020 pieces.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

AUD/USD favours extra retracements in the short term

AUD/USD kept the negative stance well in place and briefly broke below the key 0.6400 support to clinch a new low for the year on the back of the strong dollar and mixed results from the Chinese docket.

EUR/USD now shifts its attention to 1.0500

The ongoing upward momentum of the Greenback prompted EUR/USD to lose more ground, hitting new lows for 2024 around 1.0600, driven by the significant divergence in monetary policy between the Fed and the ECB.

Gold aiming to re-conquer the $2,400 level

Gold stages a correction on Tuesday and fluctuates in negative territory near $2,370 following Monday's upsurge. The benchmark 10-year US Treasury bond yield continues to push higher above 4.6% and makes it difficult for XAU/USD to gain traction.

Bitcoin price defends $60K as whales hold onto their BTC despite market dip

Bitcoin (BTC) price still has traders and investors at the edge of their seats as it slides further away from its all-time high (ATH) of $73,777. Some call it a shakeout meant to dispel the weak hands, while others see it as a buying opportunity.

Friday's Silver selloff may have actually been great news for silver bulls!

Silver endured a significant selloff last Friday. Was this another step forward in the bull market? This may seem counterintuitive, but GoldMoney founder James Turk thinks it was a positive sign for silver bulls.