The UK prime minister may have a narrow majority for his revised Brexit deal, but there are plenty of things that could derail the government's efforts to ratify the agreement before 31 October

It’s fair to say this weekend didn’t pan out the way UK prime minister Boris Johnson would have liked.

The government was hoping to finally gauge whether a majority existed for the newly-revised Brexit deal, but, in the end, MPs erred on the side of caution.

Approval of the deal would have meant that the requirements of the so-called Benn Bill would have fallen by the wayside, meaning that there would have been a latent risk of 'no deal' Brexit on 31 October. These concerns saw MPs approve an amendment ensuring that the request for an Article 50 extension was triggered regardless.

But despite this setback and with 10 days to go, the government is determined to get the Brexit deal ratified so that the UK can leave the EU on 31 October. To do this, parliament will need to pass the withdrawal agreement bill in super-fast time.

In simple terms, this is the legislation that will translate the withdrawal agreement agreed with the EU, into UK law, allowing the terms of the Brexit deal to be legally-implemented.

In theory, this should all be a formality - but in reality, it is likely to be anything but. This will be a tricky week for the government, and here are the key stages to look out for.

Where it could go wrong for UK prime minister Boris Johnson

Source: ING

1 Meaningful vote 2.0

Now that PM Boris Johnson has sent the letter asking for an Article 50 extension, there is talk that the government will have another stab at a meaningful vote.

The hope is that if the government can demonstrate it has a majority for its deal, it will give momentum to the passage of the withdrawal agreement bill (WAB) later in the week.

The good news for the prime minister is that there may now be a narrow majority for his deal after all. The Financial Times writes there are now 11 Labour MPs on-board, and when combined with the 28 pro-Brexit Conservatives, all from the European Research Group and ex-Conservative independents, means there narrowly could be enough support.

The bad news for the government is that House of Commons Speaker John Bercow is unlikely to allow the vote to go ahead. Parliamentary procedure dictates that there can't be a vote on the same motion twice. In reality, most now don't expect a meaningful vote today.

2 Second reading of the Withdrawal Agreement Bill - Tuesday

That means the first big event this week is likely to be the second reading of the Withdrawal Agreement Bill (WAB) - currently pencilled in for Tuesday, 22 October.

This is where MPs get to give their initial consent to the Brexit legislation - so effectively this is likely to be where we find out whether there really is a majority for PM Boris Johnson's deal.

The government will reportedly throw in some ways for MPs to have their say during future trade negotiations, in a bid to win over wavering lawmakers.

Clearing the second reading milestone will be a big win for the government, although, in reality, this is likely to be where the real fight begins.

3 Programme motion

If the second reading of the bill passes, then the government will need to formally spell out how it intends to get it through parliament at breakneck speed.

Don't forget that by historical standards, 10 days is a very ambitious timeframe to get a bill approved by lawmakers.

In Westminster-speak, this step is called the programme motion. Think of it as an agenda - it allocates time in the House of Commons for each of the bill's remaining stages.

Lawmakers will need to approve this timeline, and given that this is a matter of significant importance, will MPs be comfortable with the legislation going through so quickly and with minimal scrutiny? This could be a challenge for the government, and failure to get this motion approved will basically rule out leaving the EU on 31 October.

Incidentally, it is at this point that the EU may decide to make its decision on another Article 50 extension. If it becomes clear that October ratification of the Brexit deal is not possible, then more time will inevitably be required. The UK has asked for a three-month extension, although it's possible that EU leaders push for a longer time-frame with an option to shorten it if ratification is achieved earlier than expected.

4 The amendments (committee stage)

However, if MPs give their blessing to the government's accelerated timeline, the process will move to the committee stage. This is where MPs put forward amendments - and this could make-or-break the government's ambitions of getting the Brexit deal ratified this side of a general election. You can safely bet there will be an amendment put forward to make ratification of the deal conditional on holding a second referendum. But despite the Labour Party giving their blessing, most do not think this has the numbers in parliament.

There may also be amendments trying to add conditions to the payment of the £39bn 'divorce bill'. But the real focus will be on an amendment to try and force the government into negotiating customs union access as part of future trade talks.

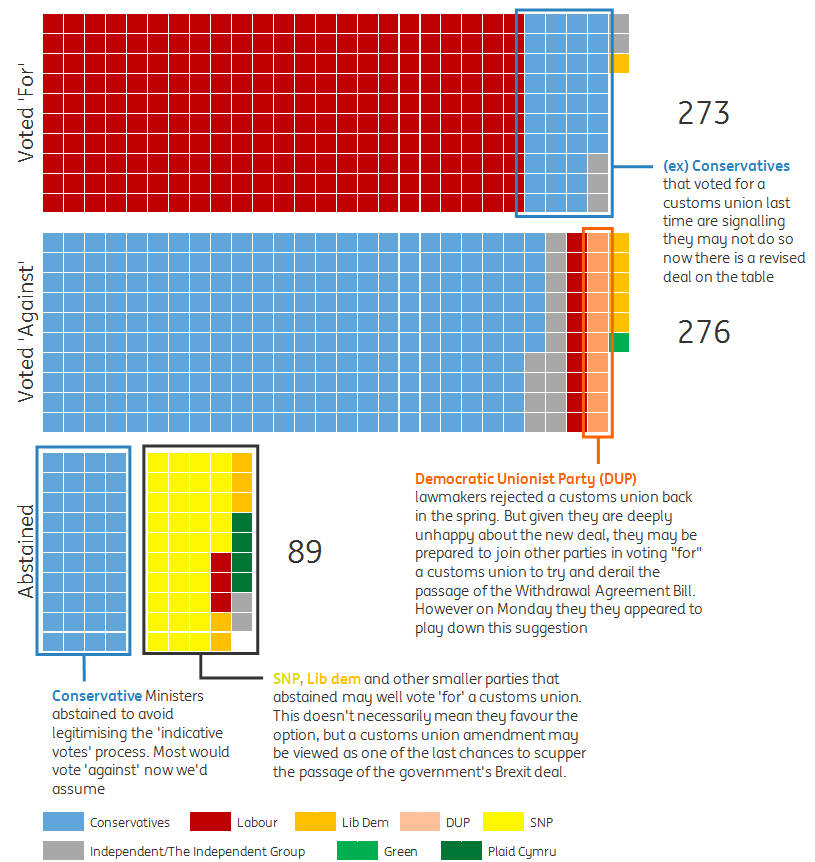

The last time this was voted on - as part of the so-called 'indicative votes' was in the Spring - the idea was narrowly defeated. 273 MPs voted in favour of remaining in a customs union with the EU, while 276 voted against. But things could be a little different now.

If the customs union amendment passes, the assumption is that the bill would lose the support of the 28 staunch pro-Brexit Conservative MPs - potentially killing off the fragile majority for the prime minister's deal.

Back in April, 89 lawmakers abstained, but a fair chunk of them may be more minded to vote 'for' a customs union this time around. That includes 35 Scottish National party lawmakers. They are probably no keener on this kind of future trading relationship than they were back in April, but they will be acutely aware that this amendment is probably their best chance of derailing the government's efforts to get its deal ratified.

If the customs union amendment passes, the assumption is that the bill would lose the support of the 28 staunch pro-Brexit Conservative MPs - potentially killing off the fragile majority for the prime minister's deal. The vote will undoubtedly be close, particularly now the Democratic Unionist Party (DUP) have said they will not support this kind of amendment.

But if a customs union amendment were to pass, then the government will face a difficult choice. Either they can plough on and try to ratify the agreement anyway - after all, if the Conservatives get a majority at the next election, then they can simply remove any elements of the WAB they don't like. Alternatively, they could decide to pull the plug on the whole thing and take the fight to a general election.

Lawmakers narrowly rejected a customs union in indicative votes back in April

Source: ING, Financial Times

5 A vote on whether to trigger a general election - later in the week

If the government goes with the latter option, then there may well be a vote at some point this week on whether to trigger a general election. That could feasibly see the UK go to the polls in late November or early December.

But as we discussed last week, Labour MPs will also need to agree to an election - and with the Conservatives flying in the polls, many will be very reluctant.

These lawmakers are unlikely to be able to resist the pressure for an election forever, but there is growing talk that the timing of it could slip into 2020. Labour MPs may be hoping that some of the recent Conservative momentum will fade over the winter, which could in-turn help Labour shift attention back to its domestic agenda.

Read the original analysis here: Five big Brexit hurdles facing Boris Johnson this week

Content disclaimer: This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more here: https://think.ing.com/content-disclaimer/

Recommended Content

Editors’ Picks

EUR/USD holds steady near 1.0650 amid risk reset

EUR/USD is holding onto its recovery mode near 1.0650 in European trading on Friday. A recovery in risk sentiment is helping the pair, as the safe-haven US Dollar pares gains. Earlier today, reports of an Israeli strike inside Iran spooked markets.

GBP/USD recovers toward 1.2450 after UK Retail Sales data

GBP/USD is rebounding toward 1.2450 in early Europe on Friday, having tested 1.2400 after the UK Retail Sales volumes stagnated again in March, The pair recovers in tandem with risk sentiment, as traders take account of the likely Israel's missile strikes on Iran.

Gold: Middle East war fears spark fresh XAU/USD rally, will it sustain?

Gold price is trading close to $2,400 early Friday, reversing from a fresh five-day high reached at $2,418 earlier in the Asian session. Despite the pullback, Gold price remains on track to book the fifth weekly gain in a row.

Bitcoin Price Outlook: All eyes on BTC as CNN calls halving the ‘World Cup for Bitcoin’

Bitcoin price remains the focus of traders and investors ahead of the halving, which is an important event expected to kick off the next bull market. Amid conflicting forecasts from analysts, an international media site has lauded the halving and what it means for the industry.

Geopolitics once again take centre stage, as UK Retail Sales wither

Nearly a week to the day when Iran sent drones and missiles into Israel, Israel has retaliated and sent a missile into Iran. The initial reports caused a large uptick in the oil price.