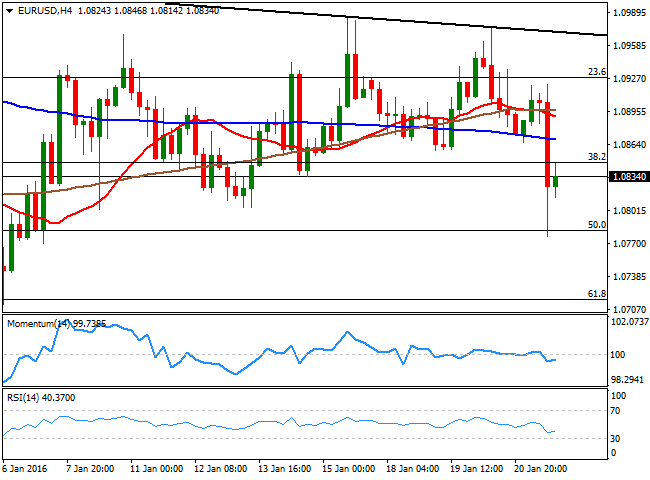

EUR/USD Current Price: 1.0835

View Live Chart for the EUR/USD

ECB's President, put a halt in risk-aversion trading this Thursday, by offering quite a dovish speech after leaving the EU economic policy unchanged. The European Central Bank opened doors for further easing, announcing a probable revision of the ongoing measures next March, giving a boost to local share markets that dragged US indexes and even commodities higher. Whether this positive mood will hold Chinese and oil upcoming onslaughts that no doubts will come back shortly, is something yet to be seen. In the meantime, Draghi also said that rates will remain at current levels or lower for an extended period of time, adding that the downside risk has increased again. Majors reversed course, with commodity currencies benefiting from the sudden comeback in stocks and goods, and the EUR and the JPY giving back some ground.

The EUR/USD pair fell down to 1.0770, but quickly bounced, meeting buying interest around the 50% retracement of the December rally, holding afterwards below 1.0845, the 38.2% retracement of the same rally. From a technical point of view, the pair seems poised to recover back towards mid-range in term, ever since the base of the latest range has held. According to the 1 hour chart, on the contrary, the risk remains towards the downside, as the price is well below its moving averages, while the technical indicators turned south after correcting extreme oversold readings. The bearish case, will remain valid as long as 1.0845 holds. In the 4 hours chart, the technical indicators are currently flat below their mid-lines, giving no clear directional clues while the price is far below its moving averages, all of which should keep the upside limited.

Support levels: 1.0800 1.0770 1.0735

Resistance levels: 1.0845 1.0890 1.0925

EUR/JPY Current price: 127.57

View Live Chart for the EUR/JPY

The EUR/JPY pair fell to a daily low of 126.15 following the ECB's head statement, but the recovery of the common currency alongside with yen intraday weakness sent it back above the 127.00, barely trading in positive territory. The longer term outlook maintains the bearish tone alive, given that the pair has set a lower low and a lower high daily basis, while trading well below its moving averages, suggesting this recovery may well be temporal. Shorter term, the 1 hour chart shows that the advance stalled at 127.86, the 200 SMA, with the price now also below the 100 SMA and the technical indicators losing upward strength after crossing their mid-lines. In the 4 hours chart, the technical indicators lack clear directional strength, having turned slightly higher within bearish territory, while the price remains far below its moving averages.

Support levels: 123.70 126.90 126.50

Resistance levels: 127.80 128.10 128.50

GBP/USD Current price: 1.4209

View Live Chart for the GBP/USD

The British Pound recovered against the greenback, after extending its decline down to 1.4078 earlier in the day, its lowest since March 2009. The comeback however, seems more related with the extreme oversold conditions of the pair than anything else, although the bounce in stocks in commodities and stocks also helped. The pair enters the Asian session trading around a critical level, its 20 SMA in the 4 hours chart, as the indicator has led the way higher ever since the year started, attracting selling interest every time the price bounced towards it. In the same chart, the technical indicators have bounced from oversold levels, but remain well below their mid-lines, suggesting that so far, the movement is corrective, with former lows in the 1.4250 region being the immediate resistance. Some follow through beyond this last could see the recovery extending in the last trading day of the week, up to 1.4339, this week high.

Support levels: 1.4190 1.4145 1.4110

Resistance levels: 1.4250 1.4290 1.4340

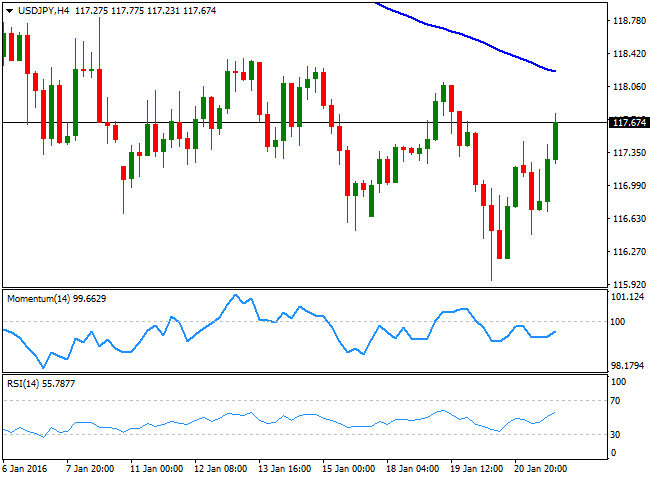

USD/JPY Current price: 117.67

View Live Chart for the USD/JPY

The USD/JPY trades at a two-day high by the end of the day, set at 117.77, favored by the improved market's sentiment, but also on the back of BOJ's Kuroda recent comments, pointing that while he is not thinking on adopting a negative interest rate policy now, he remains open to continue easing until inflation is stable at 2%. The BOJ's has no plans to act immediately, but pressure is mounting towards fresh action as conditions continue to deteriorate while inflation remains subdued. From a technical point of view, the 1 hour chart shows that the price has advanced above its 100 and 200 SMAs, while the technical indicators are losing their bullish strength near overbought levels. In the 4 hours chart, further gains are still unclear, given that the price remains far below a bearish 100 SMA, currently around 128.20, while the technical indicators have turned flat below their mid-lines, lacking directional strength.

Support levels: 116.90 116.40 115.95

Resistance levels: 117.80 118.20 118.65

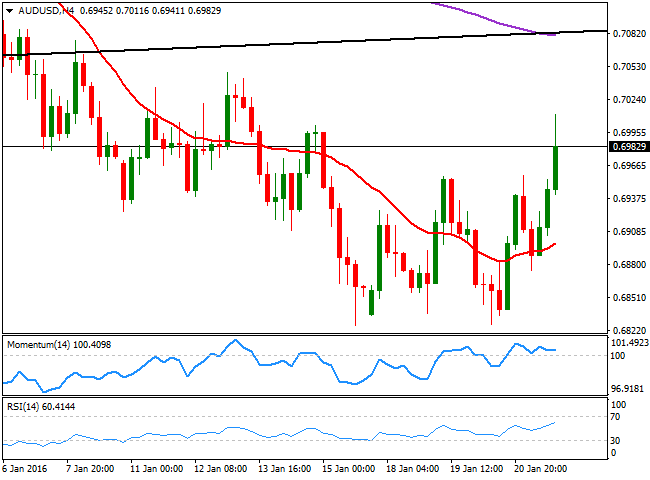

AUD/USD Current price: 0.6983

View Live Chart for the AUD/USD

The Aussie was among the most benefited by the sudden change in market's mood, advancing against the greenback up to 0.7011 intraday. Oil prices recovered towards the $30.00 a barrel region after posting fresh multi-year lows on Wednesday, with precious metal following, supporting commodity-related currencies. The pair retains the positive tone ahead of Asian opening, as the 1 hour chart shows that the price remains near its highs, and far above a strongly bullish 20 SMA, while the technical indicators consolidate near overbought levels. In the 4 hours chart, a double bottom around 0.6825 has been confirmed, given that the price is now above the neckline of the figure at 0.6960, now a key support. In the same chart, the 20 SMA is turning higher well below the current price, while the Momentum indicator holds above its 100 level, and the RSI indicator heads north around 61, supporting a continued advance, on renewed strength above the 0.7000 figure.

Support levels: .6960 0.6920 0.6870

Resistance levels: 0.7010 0.7045 0.7080

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

EUR/USD stabilizes near 1.0550, looks to post weekly gains

EUR/USD continues to fluctuate in a tight channel at around 1.0550 in the American session on Friday as trading action remains subdued with US financial markets heading into the weekend early. The pair looks to end the week in positive territory.

GBP/USD loses traction, retreats below 1.2700

After climbing to its highest level in over two weeks at 1.2750, GBP/USD reverses direction and declines to the 1.2700 area on Friday. In the absence of fundamental drivers, investors refrain from taking large positions. Nevertheless, the pair looks to snap an eight-week losing streak.

Gold pulls away from daily highs, holds near $2,650

Gold retreats from the daily high it set above $2,660 but manages to stay afloat in positive territory at around $2,650, with the benchmark 10-year US Treasury bond yield losing more than 1% on the day. Despite Friday's rebound, XAU/USD is set to register losses for the week.

Bitcoin attempts for the $100K mark

Bitcoin (BTC) price extends its recovery and nears the $100K mark on Friday after facing a healthy correction this week. Ethereum (ETH) and Ripple (XRP) closed above their key resistance levels, indicating a rally in the upcoming days.

Eurozone PMI sounds the alarm about growth once more

The composite PMI dropped from 50 to 48.1, once more stressing growth concerns for the eurozone. Hard data has actually come in better than expected recently – so ahead of the December meeting, the ECB has to figure out whether this is the PMI crying wolf or whether it should take this signal seriously. We think it’s the latter.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.