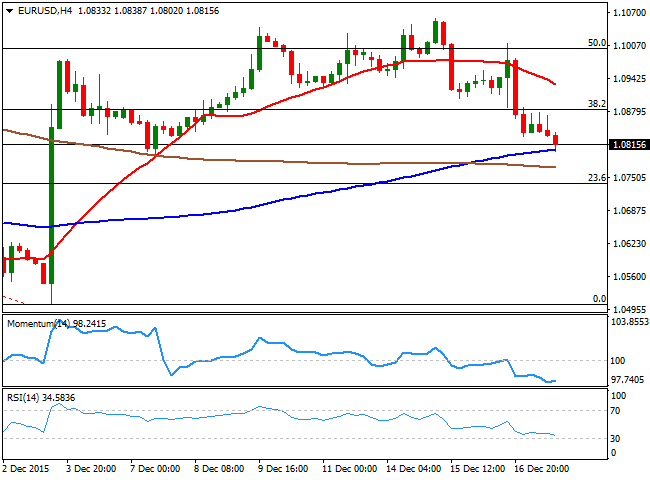

EUR/USD Current price: 1.0815

View Live Chart for the EUR/USD

The American dollar ended the day with gains against all of its major rivals, extending is post-FED helped by a steep decline in commodities' prices. The EUR/USD pair started the day with a soft tone, and traded below 1.0880, the 38.2% retracement of the latest monthly decline, failing to recover above it on an early attempt to advance. The common currency was dumped following the release of the German IFO survey, showing that business confidence in the country unexpectedly declined in December. US data was mixed, with the weekly jobless claim resulting better-than-expected by falling to 271K in the week ending on December 11, although the manufacturing sector remains subdued, as the Philly FED index came out at -5.9 for December, against previous 1.9.

The short term picture for the pair suggests the decline is not yet over, as in the 1 hour chart the technical indicators have resumed their declines after limited upward corrective movements within negative territory, while the price is currently developing well below its moving averages. In the 4 hours chart, the 20 SMA heads lower well above the current level, the RSI indicator heads lower near 34, while the Momentum indicator has lost its bearish strength, but holds near overbought levels, all of which supports a bearish continuation for this Friday.

Support levels: 1.0790 1.0750 1.0720

Resistance levels: 1.0840 1.0880 1.0915

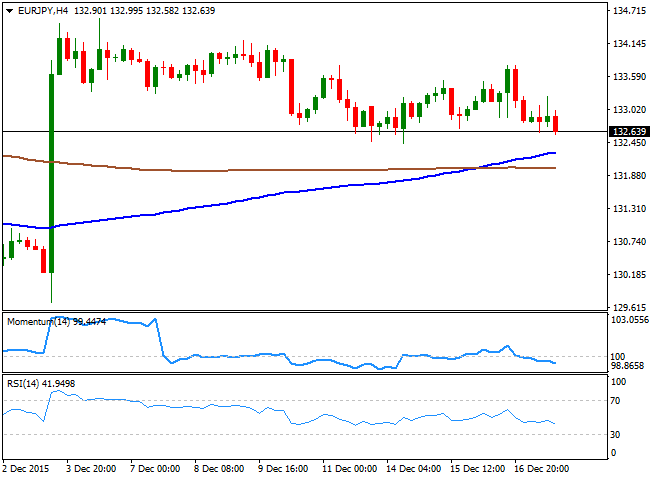

EUR/JPY Current price: 132.65

View Live Chart for the EUR/JPY

The EUR/JPY pair gave back all of its recent gains and trades near the 2-week low posted this Monday at 132.43, as the common currency lost its post-ECB attractive. Despite that the Japanese yen eased to fresh lows against the greenback EUR self weakness outpaced the safe-haven one, indicating the decline may extend into next week. From a technical point of view, the bias is towards the downside, as in the 1 hour chart, the price is developing below a mild bearish 10 SMA, currently offering an immediate resistance around 133.00,, while the technical indicators remain below their mid-lines, although showing no directional strength. In the 4 hours chart, the Momentum indicator heads south below its 100 level, while the RSI indicator also points lower around 42, supporting a downside continuation, particularly on a break below the mentioned weekly low.

Support levels: 132.45 132.10 131.70

Resistance levels: 133.00 133.45 133.90

GBP/USD Current price: 1.4878

View Live Chart for the GPB/USD

Investors kept selling the Pound all day long, and despite the UK Retail Sales figures resulted better-than-expected. In fact, the release of November data, showing that sales grew by 1.7% compared to October, and by 5.0% in a year-on-year comparison, sent the GBP/USD pair up to a daily high of 1.5007, giving sellers the perfect opportunity to jump into dollar's strength, as the pair shed over 50 pips in a few minutes, and extended its decline further lower afterwards. The pair stands at a fresh 8-month low ahead of the Asian opening, and with the intraday technical readings showing that the bearish pressure remains intact, as the technical indicators in the 1 hour chart, show no aim of turning higher and continue heading south near oversold levels. In the 4 hours chart, the technical indicators are losing their bearish strength, but remain in oversold territory. Should the price fall below 1.4850, further falls are to be expected, initially towards the 1.4780 region.

Support levels: 1.4850 1.4815 1.4780

Resistance levels: 1.4940 1.4985 1.5050

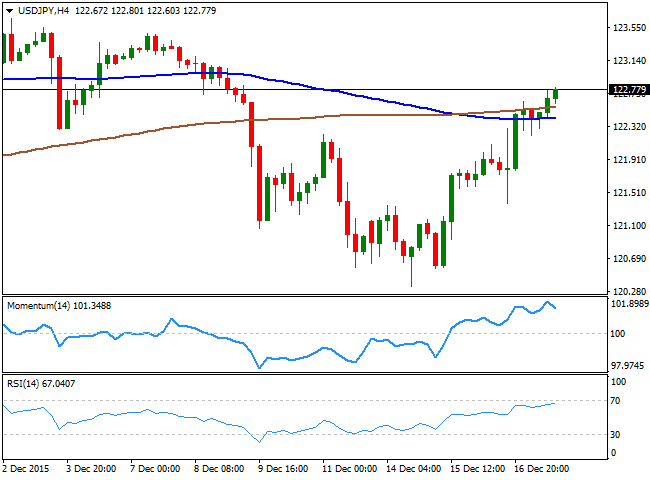

USD/JPY Current price: 122.77

View Live Chart for the USD/JPY

The USD/JPY pair recovered ground this Thursday, reaching a daily high of 122.80 and holding nearby ahead of the Asian opening, when the Bank of Japan will have its monthly economic meeting. However, recent upbeat data points to an on-hold stance from the BOJ, in its last policy decision of the year, despite inflation remains far below the 2.0% target. Anyway, the pair hold into gains even despite US stocks turned sharply lower in the American afternoon, and the 1 hour chart shows that the price holds well above its 100 and 200 SMAs, with the shortest slowly advancing below the largest. In the same chart, the RSI indicator stands flat near overbought territory, while the Momentum indicator lacks directional strength, but holds in positive territory, far from suggesting a short term decline. In the 4 hours chart, the price has advanced above its moving averages for the first time in over a week, while the RSI indicator heads strongly higher near overbought levels and the Momentum indicator hovers also near overbought territory.

Support levels: 122.60 122.20 121.70

Resistance levels: 123.00 123.40 123.75

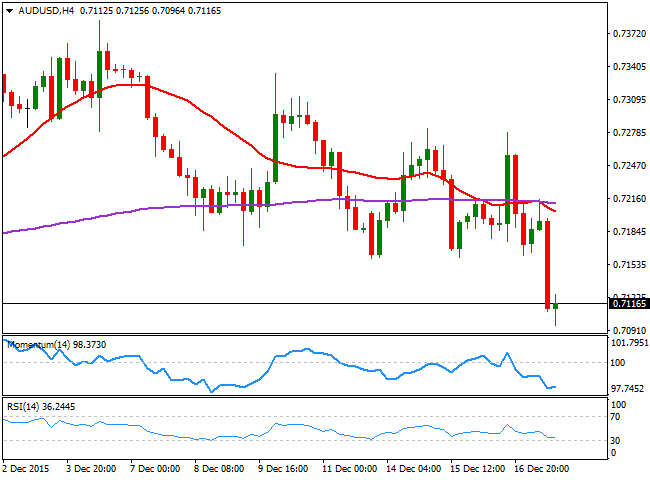

AUD/USD Current price: 0.7116

View Live Chart for the AUD/USD

The AUD/USD pair fell to its lowest in 4 weeks, plummeting below the 0.7100 level on the back of gold prices' slide. The Aussie was holding relatively well against dollar strength, but gave up at the beginning of the American afternoon, when spot gold shed around $17.00 in a couple of hours. Technically speaking, the bias is still towards the downside, albeit in the short term, the technical indicators have lost their bearish strength near oversold territory, while in the 1 hour chart, the 20 SMA has turned sharply lower above the current level, now acting as a dynamic resistance around 0.7165. In the 4 hours chart, the pair fell further below its 200 EMA, while the 20 SMA is gaining bearish slope, both far above the current level, while the technical indicators are losing their bearish strength near oversold territory, but far from supporting an upward move for this Friday.

Support levels: 0.7090 0.7050 0.7010

Resistance levels: 0.7160 0.7200 0.7240

-------

What will 2016 bring to the Forex traders? Attend our event, Forex Forecast 2016 - The Panel with Ashraf Laidi, Valeria Bednarik, Boris Schlossberg, Adam Button, Ivan Delgado and Dale Pinkert. Register for the live event on Dec. 18th and get the recording too.

-------

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

EUR/USD treads water just above 1.0400 post-US data

Another sign of the good health of the US economy came in response to firm flash US Manufacturing and Services PMIs, which in turn reinforced further the already strong performance of the US Dollar, relegating EUR/USD to the 1.0400 neighbourhood on Friday.

GBP/USD remains depressed near 1.2520 on stronger Dollar

Poor results from the UK docket kept the British pound on the back foot on Thursday, hovering around the low-1.2500s in a context of generalized weakness in the risk-linked galaxy vs. another outstanding day in the Greenback.

Gold keeps the bid bias unchanged near $2,700

Persistent safe haven demand continues to prop up the march north in Gold prices so far on Friday, hitting new two-week tops past the key $2,700 mark per troy ounce despite extra strength in the Greenback and mixed US yields.

Geopolitics back on the radar

Rising tensions between Russia and Ukraine caused renewed unease in the markets this week. Putin signed an amendment to Russian nuclear doctrine, which allows Russia to use nuclear weapons for retaliating against strikes carried out with conventional weapons.

Eurozone PMI sounds the alarm about growth once more

The composite PMI dropped from 50 to 48.1, once more stressing growth concerns for the eurozone. Hard data has actually come in better than expected recently – so ahead of the December meeting, the ECB has to figure out whether this is the PMI crying wolf or whether it should take this signal seriously. We think it’s the latter.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.