The price of Crude Oil turns negative in its first trading session of the week dragged by the IMF world growth estimate cut.

Crude Oil retraces 7 cents or 0.12% touching $58.67 per barrel, while Brent Oil advances 10 cents or 0.16% raising to $65.16 per barrel.

The International Monetary Fund (IMF) turned more pessimistic on Monday in the World Economic Forum developed in Davos.

The IMF warned that global perspectives continue being sluggish and do not foresee any recovery sign in the short-term. The institution that, in October 2019, projected a growth of 3.4% for 2020, cut its projections to 3.3% for 2020.

IMF representatives noted that there is still no recovery for the global economy. However, some of the significant risk factors for the global economy have receded.

Technical Overview

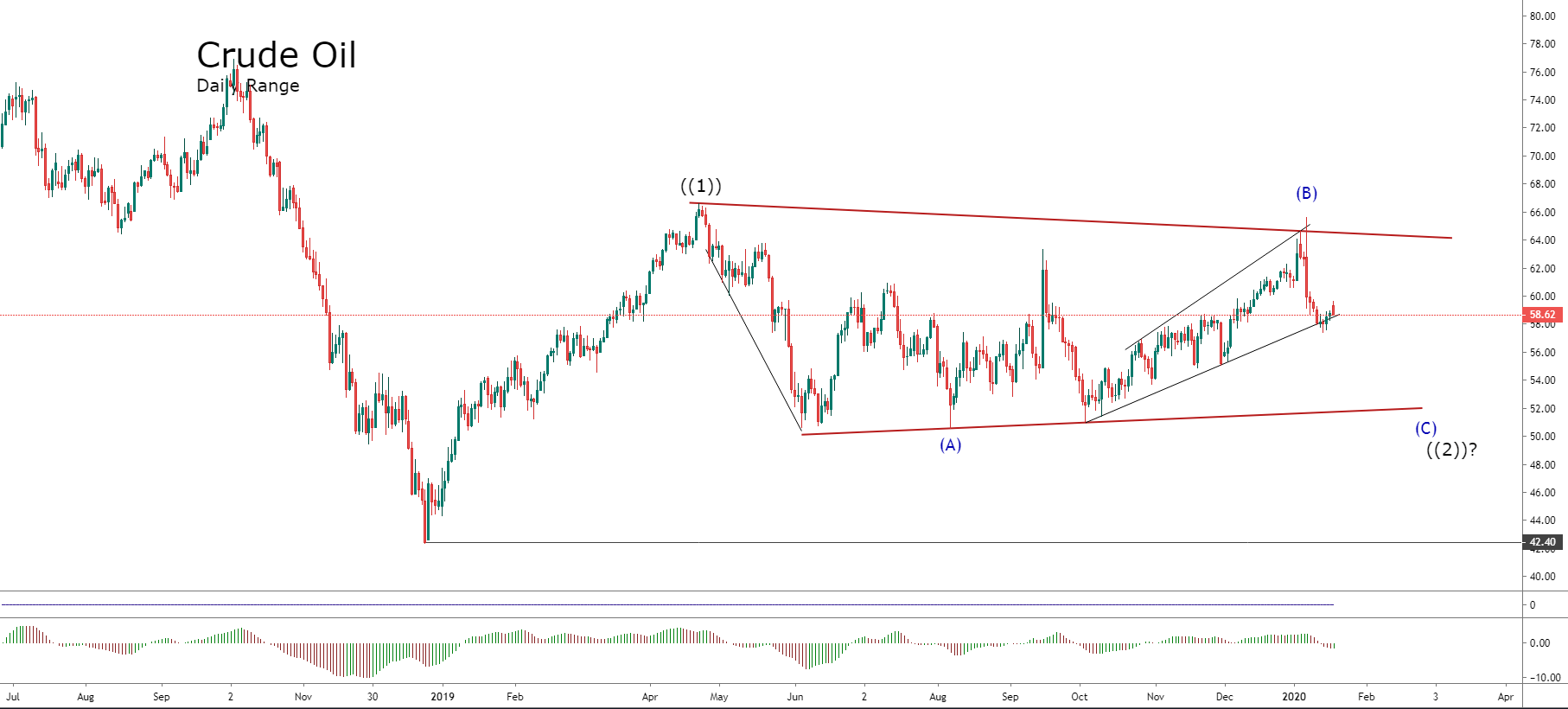

Crude Oil, in its daily chart, exposes the long-term corrective process that the energy commodity develops since the early second quarter of 2019.

The long-term consolidation structure looks like an incomplete triangle formation. The first bearish leg of the corrective sequence began on April 23rd, 2019, when the price reached $66.58 per barrel.

Once reached the 2019's high, Crude Oild started to decline in a corrective zig-zag pattern (5-3-5) and ended at $50.63.

In terms of the Elliott wave analysis, Crude Oil runs in a bearish leg (C) of intermediate degree labeled in blue. The current bearish movement began on January 08th, 2020, when the price found sellers at $65.62 per barrel.

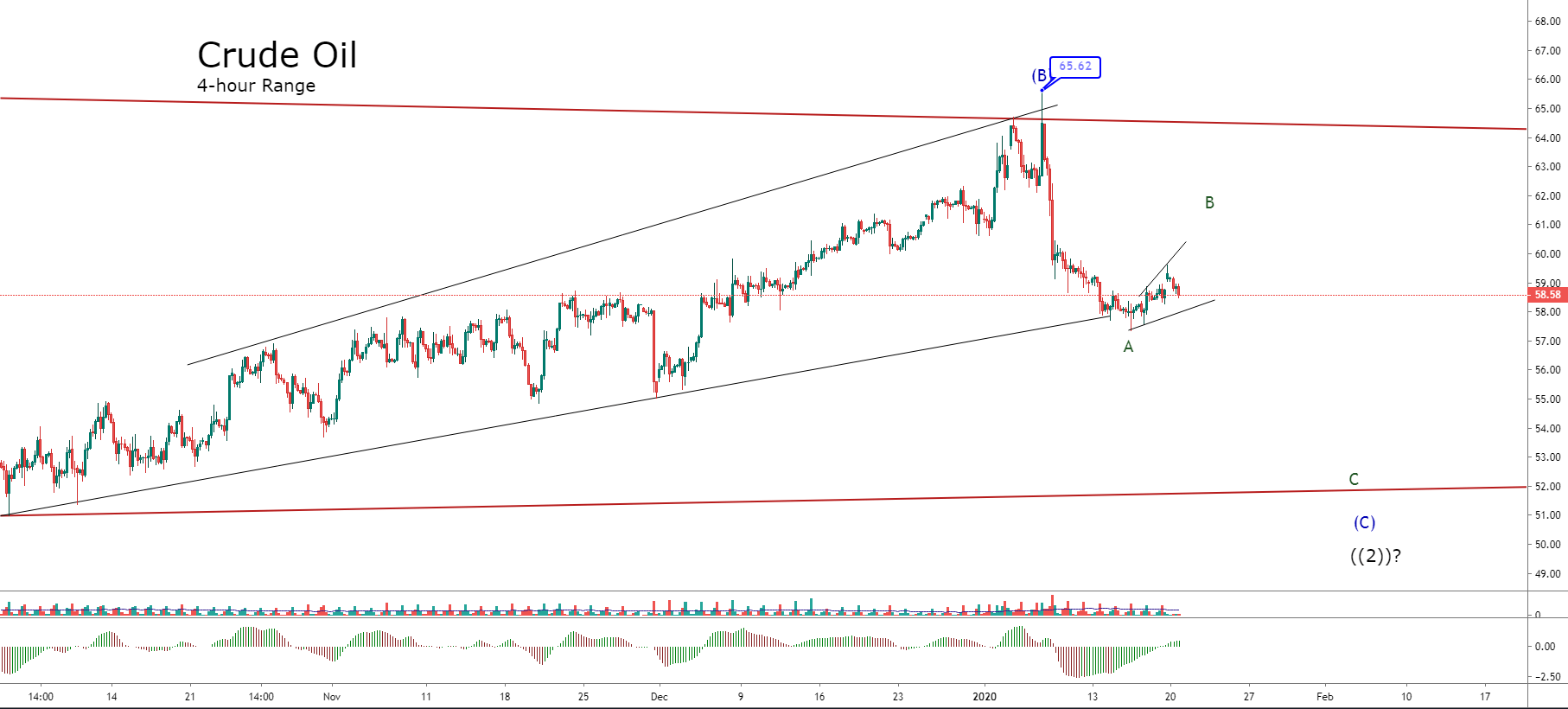

The following chart shows Crude Oil in its 4-hour chart. From the figure, there we observe that the price runs in a wave B of Minor degree labeled in green.

According to the wave theory, a wave B of a corrective formation holds a three-wave internal sequence. In consequence, Crude Oil should develop a new marginal upside, which could bring the opportunity for bearish trades, looking for a further downward leg.

From the Alternation principle's perspective, in view that the first bearish segment was developed in a fast sequence, the next segments B and C should progress at a slower pace than the first leg.

In conclusion, the Crude Oil price could develop a new marginal rise. This movement could be indicative of more weakness for the mid-term. However, we don't expect declines below the August 07th, 2019 low at $50.55 per barrel.

Risk Warning: CFD and Spot Forex trading both come with a high degree of risk. You must be prepared to sustain a total loss of any funds deposited with us, as well as any additional losses, charges, or other costs we incur in recovering any payment from you. Given the possibility of losing more than your entire investment, speculation in certain investments should only be conducted with risk capital funds that if lost will not significantly affect your personal or institution’s financial well-being. Before deciding to trade the products offered by us, you should carefully consider your objectives, financial situation, needs and level of experience. You should also be aware of all the risks associated with trading on margin.

Recommended Content

Editors’ Picks

EUR/USD clings to gains near 1.0700, awaits key US data

EUR/USD clings to gains near the 1.0700 level in early Europe on Thursday. Renewed US Dollar weakness offsets the risk-off market environment, supporting the pair ahead of the key US GDP and PCE inflation data.

USD/JPY keeps pushing higher, eyes 156.00 ahead of US GDP data

USD/JPY keeps breaking into its highest chart territory since June of 1990 early Thursday, recapturing 155.50 for the first time in 34 years as the Japanese Yen remains vulnerable, despite looming intervention risks. The focus shifts to Thursday's US GDP report and the BoJ decision on Friday.

Gold price lacks firm intraday direction, holds steady above $2,300 ahead of US data

Gold price remains confined in a narrow band for the second straight day on Thursday. Reduced Fed rate cut bets and a positive risk tone cap the upside for the commodity. Traders now await key US macro data before positioning for the near-term trajectory.

Injective price weakness persists despite over 5.9 million INJ tokens burned

Injective price is trading with a bearish bias, stuck in the lower section of the market range. The bearish outlook abounds despite the network's deflationary efforts to pump the price. Coupled with broader market gloom, INJ token’s doomed days may not be over yet.

Meta takes a guidance slide amidst the battle between yields and earnings

Meta's disappointing outlook cast doubt on whether the market's enthusiasm for artificial intelligence. Investors now brace for significant macroeconomic challenges ahead, particularly with the release of first-quarter gross domestic product (GDP) data on Thursday.