- China's manufacturing economy has started to emerge from a draconian COVID-19 lockdown

- Chinese Non-Manufacturing PMI will be closely observed by the markets, expecting a big recovery number.

Chinese Non-Manufacturing PMI and NBS Manufacturing PMI, both for March, are due today at 0100GMT. This data will be the first since China started to emerge from the peak of the COVID-19 epidemic and a draconian lockdown. Both PMIs are expected to rebound substantially, as Febusrays was not a high bar to cross and considering conditions are on the path to gradually revert to their normal trend.

Expectations

- Manufacturing expected 44.8% MoM, prior 35.7%

- Non-manufacturing expected 42.0% YoY, prior 29.6%

- Composite prior 28.9.

PMI figures, which are calculated with data from monthly surveys of private sector companies, are considered as a key indicator of a county's economic health. China makes up a third of world manufacturing and is the world's largest exporter and the restrictions in place in the so-called "factory of the world" harmed companies such as Apple, Diageo and major auto industry names which rely on China's production and consumer market. This data will paint an outlook for global trade and the health of the economy once the world emerges out from the COVI-19 crisis, hence, today's data could be a market mover.

The Chinese economy experienced a difficult 2019 due to the impact of the Sino-US trade war which equated to slowing consumption and no matter how soon China gets back to work, it is expected that economic growth will take a significant hit in the first half of this year. However, it should be recalled that although Hubei Province has been the epicentre that accounted for over 70% of the confirmed cases, the impact on the entire Chinese manufacturing industry will have been limited as its share in the country’s manufacturing industry is small.

Positively, however, we have started to see much better activity in March which will be reflected in today's data. Last month, factory activity in China fell at a record rate with manufacturers closed in order to contain the spread of coronavirus. The country's official measure of manufacturing activity - the Purchasing Manager's Index (PMI) - dropped to 35.7 from 50 in January.

How will the data affect the markets?

A focus will be with commodities, (metals and oil in the main) global equities, (cash and futures, (the ASX 200 rebounded very sharply yesterday, with its 7.0% gain the largest on record)), and the FX space. AUD is the proxy to this data.

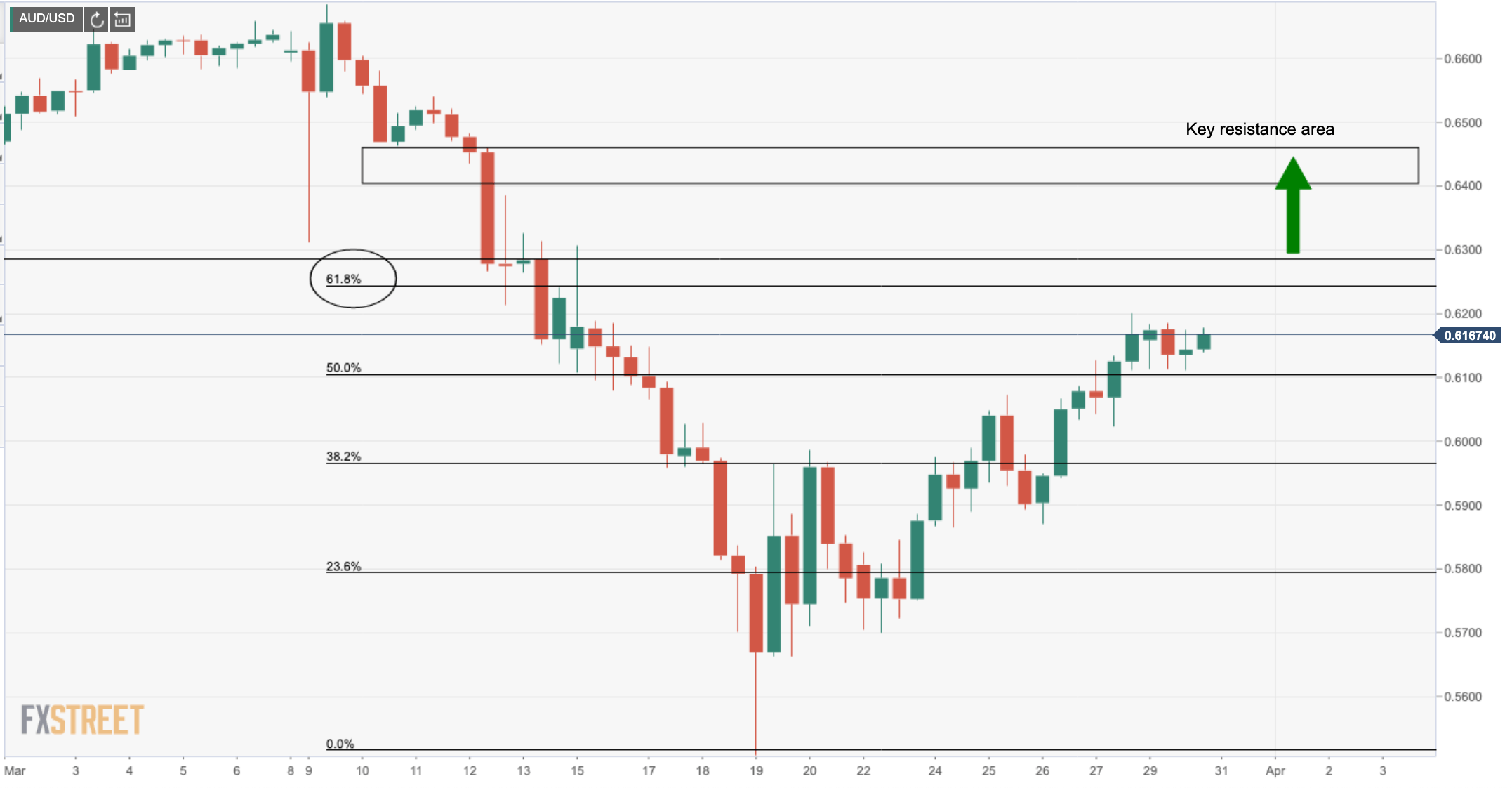

we are yet to see how tuned in FX is to economic data considering the array of stimulus measures implemented by governments and banks to battle against the invisible enemy. Investors will be twice shy about entering long of an instrument in the face of higher fluid COVID-19 risks. On the other hand, considering how AUD has begun to correct, a nudge from the data which could positively impact commodities, (CRB index needs a booster), bulls could find that they have a green light to chase down upside targets beyond 0.6230 (a 61.8% Fibonacci of the March drop) with sights on a 78.6% and a confluence of support at 0.6430:

Overall, the manufacturing industry is one of those with large numbers of workers and will face great challenges. After the wave of resumption of work, labour-intensive manufacturing will face a higher uncertainty because of the epidemic.

While we expect to see an improvement today, the big question now is how a large number of people returning to work from their hometowns all over China will play out considering the increased mobility of people and the increased density of people in public places. This experiment serves to risk the potential spread of the epidemic again, but for the sake of the global economy, the world has little choice. One thing we can count on is that pollution will be back, so enjoy those blue winter skies in China while you still can.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

AUD/USD recovers to near 0.6450, shrugs off mixed Australian jobs data

AUD/USD is rebounding to near 0.6450 amid renewed US Dollar weakness in the Asian session on Thursday. The pair reverses mixed Australian employment data-led minor losses, as risk sentiment recovers.

USD/JPY bounces back toward 154.50 amid risk-recovery

USD/JPY bounces back toward 154.50 in Asian trading on Thursday, having tested 154.00 on the latest US Dollar pullback and Japan's FX intervention risks. A recovery in risk appetite is aiding the rebound in the pair.

Gold rebounds on market caution, aims to reach $2,400

Gold price recovers its recent losses, trading around $2,370 per troy ounce during the Asian session on Thursday. The safe-haven yellow metal gains ground as traders exercise caution amidst heightened geopolitical tensions in the Middle East.

Manta Network price braces for volatility as $44 million worth of MANTA is due to flood markets

Manta Network price was not spared from the broader market crash instigated by a weakness in the Bitcoin market. While analysts call a bottoming out in the BTC price, the Web3 modular ecosystem token could suffer further impact.

Investors hunkering down

Amidst a relentless cautionary deluge of commentary from global financial leaders gathered at the International Monetary Fund and World Bank Spring meetings in Washington, investors appear to be taking a hiatus after witnessing significant market movements in recent weeks.